Judicial

Tax or penalty? The fireworks have just begun

Contrary to his conclusion in the majority brief, Justice Roberts affirmed that “Patient Protection and Affordable Care Act”, HR3590, is unconstitutional. To know why, see Article 1, Section 7, Paragraph 1 of the Constitution (the “Origination Clause”). But watch how the Obama administration and its sympathizers in the media have reacted. Listen to the idiots in Congress as they scream that the Supreme Court erred, and penalties are not taxes. That tells me that they know that any tax revenue bill that starts in the Senate is unconstitutional. They will keep arguing, as Congress did, that a penalty is not a tax. And you can bet that they will argue this on cross-examination if any of the 26 Attorneys General notifies the Court that they will request re-argument.

Hypothetically, what if we all agree with Solicitor General Verrilli, that a penalty is not a tax. What about all the penalties the Quisling Roberts and the mentally challenged liberals on the bench would have to rule on at re-argument, whether “tax” or “penalty” were one in the same? Obviously none of those arguing on either side of this controversy or the Court read the Bill!

A Tax, is a Tax, is a Tax!

As I said and proved in my last article, District Court Judge Roger Vinson affirmed that the “Bill” originated in the Senate. (Have a look at this link. Notice that it began as the Service Members Home Ownership Tax Act of 2009? Then right after it gets on the Senate calendar, its name changes to Patient Protection and Affordable Care Act. This is prima facie evidence of a bait and switch! And I have already said why they did that.)

So let’s look at the Bill. (Stay with the HTML version. Maybe your computer can’t load the PDF version. That’s how whopping big this Bill is.) What do we find? Yes, it’s the word Tax. I refer to Chief Judge Roger Vinson in his previous finding (Case 3:10-cv-00091). He noted that Section 10907 of “H.R.3590” explicitly imposed taxes on indoor tanning salons. Their customers pay this tax as a “service” tax. This clearly breaks the Constitution’s “capitation” provision. And here you see that pesky word tax, not penalty. Now read Article 1, Section 9, Clause 4:

No capitation or other direct tax shall be laid, unless in Proportion to the census or Enumeration herein before directed to be taken.

The “Act” explicitly taxes people, without apportionment among the States, in violation of the Constitution.

Now What Have We Here?

The current Justices of the Supreme Court. Highlighted: Chief Justice John Roberts. Photo: SCOTUS; highlighting from CNAV.

The Court and the Legal Eagles arguing this case should know what a capitation tax is, and how the law defines it. A capitation tax is an assessment that the government lays on you at a fixed rate, regardless of your income or worth. This “Act” lays a fixed rate against any person who does not buy health-care insurance, and against companies that don’t give insurance to their employees. This is too is a capitation tax. The illegality is obvious! The supreme law of the land tells the federal government to lay such taxes in proportion to State populations.

Here’s another illegal tax. The “Act” taxes all medical devices exported from specific States. Thus it discriminates against the exports of States that build those devices. (See Article 1, Section 9, Clause 5.)

I could go on, but must I?

Another Issue: Waivers

Now what about those waivers that Kathleen Sebelius has given out? Those break the Constitution, too, at least technically. She clearly discriminated while giving out those waivers. That violates the “equal treatment” doctrine.

But that’s another story, and out of my scope. It took me long enough to write this second article. I wanted to enjoy Independence Day before the Marxist decides to declare martial law, and recognize no holidays but May Day and Obama’s birthday. (Will he observe that only during Ramadan? Stay tuned!)

Look forward to my next article in this series, “The Taxman Cometh.” In it I will say further why the June 28th ruling actually makes the Act unconstitutional.

Just a note: shouldn’t we pass an Amendment to limit the terms of office of judges and Justices? These lifetime appointments to the bench are a danger to our independence. Judicial reform is long overdue. But that’s another topic.

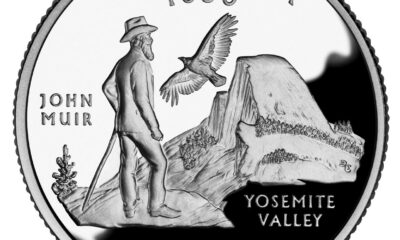

The Eagle

Related:

Supreme Court confirms: health-care law UNCONSTITUTIONAL.

[amazon_carousel widget_type=”ASINList” width=”500″ height=”250″ title=”” market_place=”US” shuffle_products=”True” show_border=”False” asin=”B00375LOEG, 0451947673, 0800733940, 0062073303, 1595230734, 1936218003, 0981559662, 1935071874, 1932172378, 1936488299″ /]

-

Accountability3 days ago

Accountability3 days agoWaste of the Day: Principal Bought Lobster with School Funds

-

Executive1 day ago

Executive1 day agoHow Relaxed COVID-Era Rules Fueled Minnesota’s Biggest Scam

-

Civilization9 hours ago

Civilization9 hours agoWhy Europe Shouldn’t Be Upset at Trump’s Venezuelan Actions

-

Constitution2 days ago

Constitution2 days agoTrump, Canada, and the Constitutional Problem Beneath the Bridge

-

Civilization1 day ago

Civilization1 day agoThe End of Purple States and Competitive Districts

-

Christianity Today9 hours ago

Christianity Today9 hours agoSurprising Revival: Gen Z Men & Highly Educated Lead Return to Religion

-

Civilization5 days ago

Civilization5 days agoThe devil is in the details

-

Executive21 hours ago

Executive21 hours agoWaste of the Day: Can You Hear Me Now?

The bill DID originate in the House, and the government solicitor made that exact point in his evidence:

“After the bill passed the House, the Senate amended it by striking its text and substituting the provisions that ultimately became the Act. After passage in the Senate, the House agreed to the bill as amended, and the enrolled bill was submitted to the President, who signed it into law. This commonplace procedure satisfied the minimal constraints of the Origination Clause; the Senate may adopt any amendment it deems advisable to a bill relating to revenues, even an amendment that is a total substitute. See Flint v. Stone Tracy Co., 220 U.S. 107, 143 (1911)”

There’s a good article here that should point out where you went wrong.

You made a distinction without a difference. Judge Vinson did not seem to agree with you that this kind of bait-and-switch satisfies the Constitution on this point.

You realise the case I cited was from the Supreme Court, right? So even if a Florida district judge ruled otherwise (and he didn’t – as explained in the article, which you obviously didn’t have the courtesy to read), it still wouldn’t make the slightest difference.