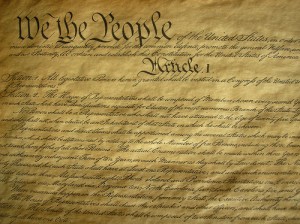

Constitution

The tax man cometh, but is it constitutional?

As I stated in my previous articles, any and all taxes implemented in Obama-care are unconstitutional. The bill originated in the Senate, and that breaks Article I, Section 7, Clause 1 of the Constitution. In my second article I proved that Obama-care breaks Article I, Section 9, clause 4, the “capitation tax” clause. I also mentioned that Kathleen Sebelius’ discriminatory and arbitrary waivers break the equal treatment principle.

The entire decision is convoluted. If I refuse to buy something that Congress dictates I buy, I can be taxed for non-compliance with a law. Yet in the same breath Chief Justice John Roberts held the ‘Commerce Clause’ doesn’t apply, but the mandate does. He said that the penalties are taxes, in essence justifying imposing the penalties by calling them taxes.

What galls me the most are these words by Roberts:

It is not our job to protect the people from the consequences of their political choices.

Roberts Court creates law.

What doesn’t the Roberts Court get? Where does the Constitution give the Judicial Branch the power to override it? How can the Court give the government new powers of taxation that the Constitution does not authorize? First and foremost, the Supreme Court is not elected. It is not the governmental body that makes laws. They cannot create new powers of taxation and grant that to the government without the consent of the People. They would need to change the Constitution to grant government those powers of taxation. John Roberts and a majority of the court invented this new power to tax. They are not the representatives of the People.

No, Mr. Chief Justice Roberts. You made law; you did not apply law! Does your oath to support and defend the Constitution mean nothing? It was your job to protect the people from unconstitutional legislation, not manipulate the meaning of the Constitution. You, sir, and your Court created law!

The pundits compare Chief Justice Roberts to Chief Justice John Marshall, and cite Marbury v Madison. Really, what was so ingenious about his findings in the Arizona v. US decision? In that case, he pronounced state sovereignty dead on arrival. But in NFIB v. Sebelius the Roberts Court resurrects state sovereignty. That sir is blatant manipulation! What are “We the People” to expect? Will you now base future decisions on a political ideology, who’s in power, what they believe the policy should be in each decision, or the mood of the day? Constitution? What constitution? Obvious, we can no longer trust any of those appointed to the bench to adhere to the stated meaning of the Constitution.

The pundits tell us that Roberts held the ‘commerce clause’ inapplicable, and thus limited Congress’ future use of it. Don’t hold your breath. The pundits do not realize that the Court just approved the greatest tax hike in U.S. History, and the greatest expansion of the federal government, since Franklin Delano Roosevelt. Just a reminder: in the stimulus package the government allocated billions for government buildings. You know what those building are going to house: the IRS.

Yes, the Tax Man cometh, but is it constitutional?

They told us they would hire 16,500 agents to investigate and collect these new taxes. But they fail to tell us about the extra auditors and support staff, the infrastructure to implement the tax oversight over one sixth the American economy. That kind of oversight will take an Army. With the IRS in control you’re looking at a future police state. And you, the tax-payer, are stuck with the bill. We have a Supreme Court overrun by political ideologues who repeatedly violate their oath of office (see Article 6 of the Constitution).

Taxation without representation is slavery

Are we looking at taxation without representation? Absolutely, for several reasons. My favorite: did Congress have authority to implement the ‘Act’ that originated in the Senate? And: does/did Mr. Obama have authority to sign any tax into law?

I can already hear it:

There he goes again.

Yes there I go again. The fatal fact remains: Congress cannot have a legitimate process of passing bills and taxes if they don’t have a valid President to sign them into law. (See Article II of the Constitution).

No matter how you look at it, that’s where the tax issue belongs. If Mr. Obama is ineligible, and the Act originated in the Senate, then “We the People” have an unconstitutional dictatorship over us. That dictatorship is forcing non-laws and illegitimate taxes. This in-and-of-itself is involuntary servitude. (See Purpura v Sibelius, Count 9.)

We now have taxation without representation. That is involuntary servitude or slavery. So Chief Justice Roberts has reintroduced slavery. He has also opened the door wide to expose the entire Congress, Obama, and the Court for reintroducing slavery via taxation without representation. It started in the Senate, where taxes cannot originate (taxation without representation). Congress then presented it to an unconstitutional President who cannot make taxes with his signature. Taxes that the minority must obey. Who is that minority? Those of us who refuse to accept him as our representative. He is born to a foreign father and is not “natural born Citizen.” Again this is taxation without representation. And then the Court , an unelected branch of government, invents the law to make it constitutional as a power to tax. That power does not even exist in the Constitution. Making a law of taxation without the consent of the People is taxation without representation again. Now their treason is complete. All branches of government have joined in reintroducing slavery in violation of the 13th Amendment and State constitutions.

The law is simple. You have direct taxes in proportion to population by the consent of the people. Those taxes are based on commerce or wealth. And before you lay an indirect tax on a person, that person must consent to receive some taxable privilege, or engage in a taxable activity. That raises the question about the “commerce clause” that was found to be unconstitutional related to Obama-care. So somehow the IRS (government) will have to explain: how does not buying insurance, if we are not required to, or compelled to according to Roberts Court, constitute a receiving a privilege or engaging in a taxable activity? Didn’t the Court find that to be unconstitutional?

Roberts created constitutional questions, that must/will be adjudicated.

Does it not stand to reason the tax is unlawful? Not buying insurance is not to consent to receive a taxable privilege or to engage in a taxable activity. So you have is nothing to tax. The “tax” for not buying insurance is not a power of taxation granted in the Constitution, because you have nothing to tax.

The people must compel the Supreme Court to adjudicate whether Mr. Obama is eligible to sign Obama-care into law, before the government makes any citizen pay a tax. No one has yet shown that Mr. Obama had authority to sign the act. By law, the IRS is without authority to compel you to pay a tax, as I like to say, for breathing. Clearly we have a valid injury. Must not the court address this issue and stop hiding behind closed doors? (User jedipauli, you may consider yourself vindicated).

Do we have a conspiracy by all three branches of government – conspiracy to raise taxes without representation? It sure looks that way to me. And another thing: can the IRS impose the penalties set forth in this legislation, despite their “unequal treatment?” Every person will be taxed at a different rate according to their income. Then we have certain religious sects that are exempt from it. What does the 14th Amendment say to this? If the penalties are now taxes, do we have to wait for someone to pay the tax to go back to Court to comply with the “The Anti-Injunction Act”?

I could go on, and on, and on. I sometimes say, What’s the use? But then I see the kids coming out of school, or children playing. Then I say we will either be the victors or the vanquished. Those children deserve the same country we older men grew up in. So we will never stop fighting. First through the law, and God forbid the law ends, and tyranny will begin. I’m invigorated to fight another day.

To all you Quislings in Congress, and to you despicable hoodlums in black-robes: wake up! And to the narcissist buffoon who spends his days in the oval office watching sports while awaiting orders from George Soros: we will never surrender our liberty or freedom!

Enough said for today.

The Eagle

Related:

- Tax or penalty? The fireworks have just begun

- Supreme Court actually confirms health care law UNCONSTITUTIONAL

[amazon_carousel widget_type=”ASINList” width=”500″ height=”250″ title=”” market_place=”US” shuffle_products=”True” show_border=”False” asin=”B00375LOEG, 0451947673, 0800733940, 0062073303, 1595230734, 1936218003, 0981559662, 1935071874, 1932172378, 1936488299″ /]

-

Accountability3 days ago

Accountability3 days agoWaste of the Day: Principal Bought Lobster with School Funds

-

Civilization7 hours ago

Civilization7 hours agoWhy Europe Shouldn’t Be Upset at Trump’s Venezuelan Actions

-

Executive1 day ago

Executive1 day agoHow Relaxed COVID-Era Rules Fueled Minnesota’s Biggest Scam

-

Constitution2 days ago

Constitution2 days agoTrump, Canada, and the Constitutional Problem Beneath the Bridge

-

Civilization1 day ago

Civilization1 day agoThe End of Purple States and Competitive Districts

-

Christianity Today7 hours ago

Christianity Today7 hours agoSurprising Revival: Gen Z Men & Highly Educated Lead Return to Religion

-

Civilization5 days ago

Civilization5 days agoThe devil is in the details

-

Executive20 hours ago

Executive20 hours agoWaste of the Day: Can You Hear Me Now?

NICHOLAS – Nice commentary!

It is so true what you say:

“Roberts created constitutional questions, that must/will be adjudicated.”

Within 1 hour of this notorius Supreme Court decision being announced, I posted the following on my blog:

“Has the Supreme Court Opened a Pandora’s Box of Unintended Consequence Worms?”

Excerpt:

……As with passage of laws and also Supreme Court decisions, there are “unintended consequences.” It appears as if the Supreme Court has rendered another decision which is somewhat muddled and compromised. Not surprisingly, there is likely to be future legal challenges……

link to moralmatters.org

Pastor emeritus Nathan Bickel

http://www.thechristianmessage.org

http://www.moralmatters.org