Legislative

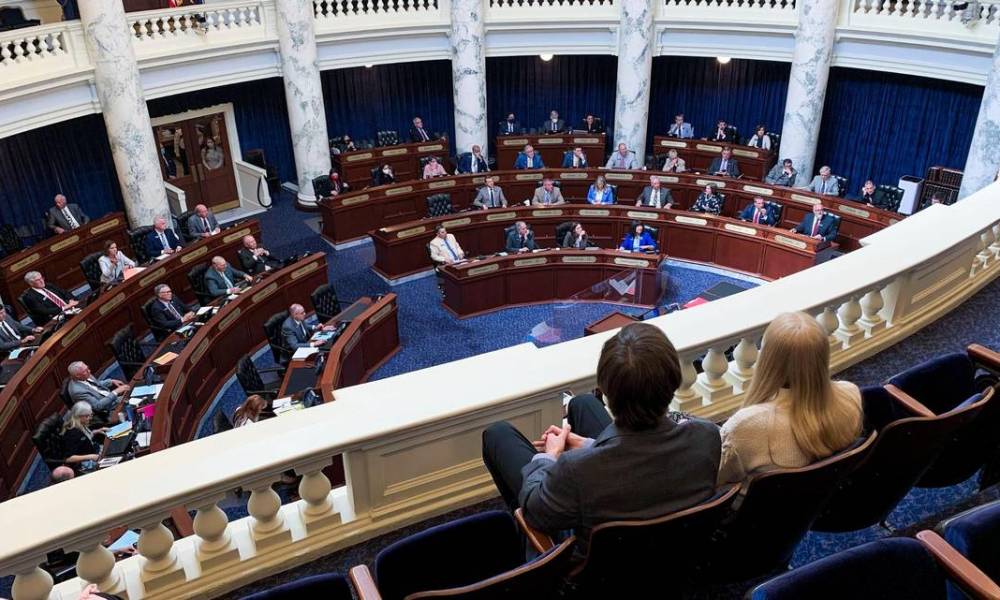

Idaho tax conformity bill collides with Republican same-sex marriage objections

A minor conformity bill to annually align Idaho with tax policy changes in federal law became the target of some Republican lawmakers Wednesday who argued it bypassed the Idaho Constitution by approving same-sex marriage.

The House issued objections as Republican Rep. Ron Nate argued that voting for the bill would be a violation of Idaho’s constitution.

Idaho voters in 2006 voted to ban gay marriage. But the US Supreme Court in 2015 made such marriages legal, negating the Idaho law.

The House ultimately voted 46-22 to approve House Bill 472, which backers said includes changes that will save Idaho taxpayers money. Passing the bill allows Idaho taxpayers to use the federal adjusted gross income on their federal return as a starting point in filling out their Idaho tax form. The federal government uses its definition of marriage to allow adjustments.

“The problem with this is that 472 does not protect our constitution in Idaho as it was amended in 2006,” Nate said in arguing against the bill on the House floor. “Using the federal definition does recognize marriages that do not fit the one-man, one-woman category marriage that we have committed to being the only recognized marriage in our state.”

But Republican Rep. Greg Chaney, an attorney, disagreed that voting for the bill violated the Idaho Constitution because gay marriage was legal under federal law.

“Not only are you not doing a better job of upholding the Idaho Constitution, you are doing an absolutely miserable job of upholding the United States Constitution,” he said, noting the state was sure to lose in court if it chose that path. “This is another example of where we’d get our rear end kicked, summarily, and then we’d pay the attorney fees for whoever sued us.”

Republican House Majority Leader Mike Moyle, the bill’s sponsor, said he recognized that many Idaho residents didn’t agree with the US Supreme Court decision involving same-sex marriage.

“This is really supposed to be a bill not about marriage and all of that stuff,” he said. “This is supposed to be a bill about tax conformity. In this bill we give back Idaho citizens a bunch of money for an increased child tax credit, increased childcare credit. We help Idahoans. And we also make it possible for our accountants to start doing the taxes.”

The bill has been submitted to the Senate for consideration.

-

Accountability2 days ago

Accountability2 days agoWaste of the Day: Principal Bought Lobster with School Funds

-

Constitution2 days ago

Constitution2 days agoTrump, Canada, and the Constitutional Problem Beneath the Bridge

-

Executive23 hours ago

Executive23 hours agoHow Relaxed COVID-Era Rules Fueled Minnesota’s Biggest Scam

-

Civilization22 hours ago

Civilization22 hours agoThe End of Purple States and Competitive Districts

-

Civilization5 days ago

Civilization5 days agoThe devil is in the details

-

Civilization4 days ago

Civilization4 days agoThe Conundrum of President Donald J. Trump

-

Executive4 days ago

Executive4 days agoTwo New Books Bash Covid Failures

-

Executive4 days ago

Executive4 days agoThe Israeli Lesson Democrats Ignore at Their Peril