Executive

Oklahoma’s Anti-ESG Law Is Not Hurting Sooner State Taxpayers or Retirees

Over the past three years, Oklahoma and 18 other Republican-controlled states passed legislation banning financial firms that pursue an environmental, social and governance (ESG) agenda from engaging in state financial business. Many of these states are, like Oklahoma, dependent on the oil and gas business for their economic and financial well-being. These anti-ESG laws are mainly defensive moves aimed at protecting the in-state energy industry from the existential funding threat posed by the climate-driven sustainable finance movement.

Oklahoma’s anti-ESG law

The ESG empire is now striking back with lawsuits challenging many of these laws on both fiscal and fiduciary grounds. Progressive ESG activists are arguing with a straight face that these laws are hurting taxpayers and retirees and wasting government money by raising the cost of public finance and public pension fund management, with ironic appeals to free-market capitalism, constitutionality and apoliticism thrown in for good measure.

Oklahoma now stands on the front line of this anti-anti-ESG legal fight. In 2022, the Sooner State passed House Bill 2034, the Energy Discrimination Elimination Act (EDEA), which prevents state and local agencies from doing business with financial institutions that boycott traditional energy companies. Under the EDEA, State Treasurer Todd Russ is required to maintain a running list of banned financial institutions engaging in energy discrimination, which the law defines as “without an ordinary business purpose, refusing to deal with, terminating business activities with, or otherwise taking any action that is intended to penalize, inflict economic harm on, or limit commercial relations with a company” active in the fossil fuel chain. Notably, any financial institution can avoid being blacklisted by simply attesting in writing to the fact that it does not boycott energy companies, which would seem like a very low bar.

The lawsuit

Oklahoma’s anti-ESG law went into effect on November 1, 2022, although the first restricted company list (which included 13 sell-side and buy-side firms) was not released until May 3, 2023. The list was whittled down to six in August 2023 and then subsequently increased to seven in May 2024. It currently includes the following companies: BlackRock, Inc. (BLK ticker), Wells Fargo & Company (WFC), JPMorgan Chase & Co. (JPM), Bank of America Corporation (BAC), State Street Corporation (STT), Climate First Bank (a small private community bank) and Barclays PLC (BCS).

In December 2023, a lawsuit was filed by Don Keenan, a state pension beneficiary and the former president of the Oklahoma Public Employees Association, alleging that the EDEA was an unconstitutional state act that created “monumental” financial costs for municipal borrowers and state retirement accounts, the latter of which must be managed for the “exclusive benefit” of their beneficiaries and not subject to a “political agenda.” In May 2024, Oklahoma County District Court Judge Sheila Stinson issued a temporary injunction pausing the enforcement of the EDEA, pending a final decision in the Keenan case.

To bolster their case that Oklahoma’s EDEA raises borrowing costs for state and local governments, opponents have relied on a recent University of Central Oklahoma study funded by the Oklahoma Rural Association (ORA) which claims that this law has resulted in $185 million of additional borrowing costs for the state since its implementation.

The data are flawed

However, as detailed in a recent report by the American Energy Institute, the ORA study is deeply flawed and highly misleading. Released in April 2024, the ORA study looks at municipal bond market trends from January 1, 2018 through March 1, 2024, which means that it captures only 10 months of actual post-EDEA data, given that the first release of the state’s list of banned financial institutions was in May 2023.

From this truncated data set, the study attempts to extrapolate the specific impact of the EDEA on state and local municipal borrowing costs by comparing government bond coupon rates in Oklahoma versus a group of surrounding states that have not passed an anti-ESG policy (Arkansas, Colorado, Kansas, and Missouri), with the anti-ESG state of Texas (since 2021) included as an additional reference point. Given the divergence in credit ratings, economic fundamentals and fiscal drivers across this arbitrary geographic peer group, this is a dubious apples-to-oranges comparison which yields little in the way of meaningful takeaways. Two of the states in the supposedly non-EDEA control group (Arkansas and Missouri) both passed anti-ESG laws in 2023, further corrupting the comparative analysis.

The facts on the anti-ESG law and its effect

Nonetheless, using a “difference of the differences” econometric regression model, the ORA study attributes an estimated 59 basis points of incremental municipal coupon rate to the EDEA, 15.7% higher than the average for Oklahoma’s neighboring states. This translates into roughly $10.9 million of additional borrowing costs per month. Multiplied by the 17 months since the passage of the EDEA, this results in the headline number of $185 million of additional financing expense through April 2024, when the ORA study was published.

Yield-to-worst before and after the law

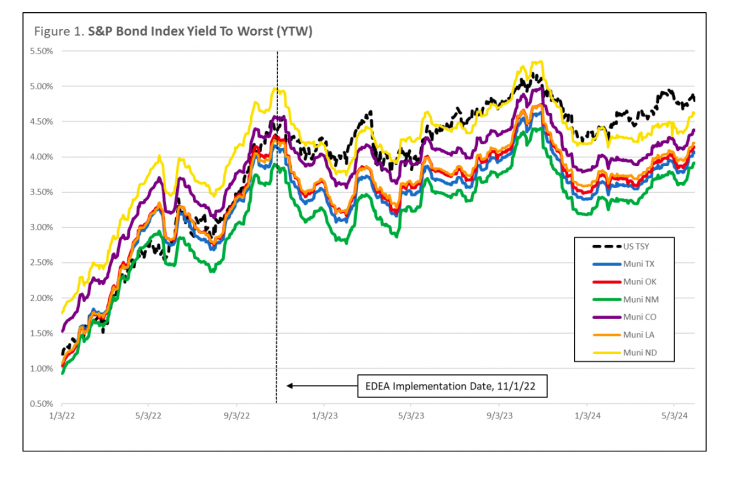

Rather than relying on subjective data interpolation and forward projections, we have the benefit of market hindsight to gauge the actual impact of the EDEA on Oklahoma’s municipal bond market. Figure 1 shows the average yield to worst (YTW), which is the best real-time measure of market borrowing rates, for the S&P Municipal Bond Oklahoma Index since the beginning of 2022. The chart compares Oklahoma to a peer group of similarly rated energy-dependent U.S. states (both with and without anti-ESG laws) including Colorado, Louisiana, New Mexico, North Dakota and Texas. The S&P U.S. Treasury Bond Index is also shown to highlight the correlation between the Treasury and municipal bond markets.

As Figure 1 illustrates, Oklahoma has not seen an absolute or relative increase in municipal bond borrowing costs since the roll-out of the EDEA. To the contrary, the average YTW for Oklahoma state and local government issuers has actually tightened by 14 basis points since October 31, 2022. Almost all of the yield volatility over the past 19 months has been driven by movements in underlying interest rates, as seen by the lockstep trading between Oklahoma and its municipal peers and the U.S. Treasury Bond Index. From 2022-2023, the main driver of higher municipal bond yields in Oklahoma and every other state (anti-ESG or otherwise) was the shift in monetary policy and the increase in U.S. Treasury yields caused by 11 rate hikes (aggregating 5.25%) by the Federal Reserve.

Summary statistics

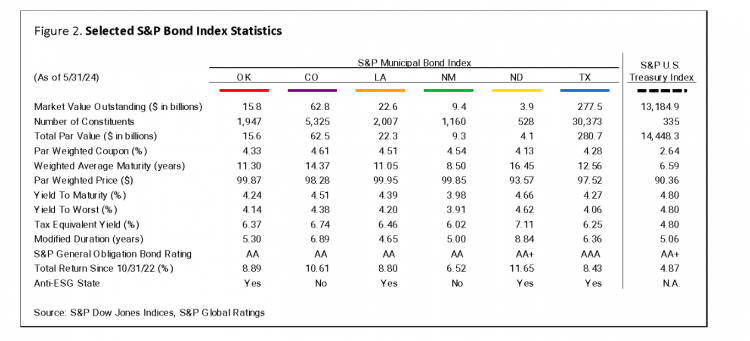

Figure 2 shows summary statistics for each of the S&P indexes highlighted in Figure 1 including aggregate post-EDEA returns for each. Since October 31, 2022, the S&P Municipal Bond Oklahoma Index has posted a total return of 8.89%, broadly in line with the performance of its energy state peers regardless of anti-ESG legislative status, after adjusting for index differences in terms of weighted-average maturity. Moreover, the credit profile of the state of Oklahoma (Aa2/AA/AA general obligation bond ratings from Moody’s Investors Service, S&P Global Ratings and Fitch Ratings, respectively) has improved over the same period, as evidenced by the recent ratings outlook change from stable to positive at both Moody’s in October 2023 and Fitch in February 2024. None of the three major rating agencies have noted the EDEA as a material credit factor in their analysis of Oklahoma’s creditworthiness over the past two years.

No market or credit impact from the anti-ESG law

The absence of any market or credit impact makes intuitive sense when one considers the thinness of the argument being made by EDEA opponents: Oklahoma municipal borrowers are now being forced to pay more in issuance costs due to a lack of competition and fewer underwriting banks in the mix. While the five banks on Oklahoma’s restricted company list accounted for an aggregate 27.6% share of the negotiated municipal bond market in 2023, this still leaves six of the top 10 municipal underwriters plus several energy-focused regional bank players.

Moreover, the municipal bond market remains highly competitive. Total new issuance has declined over the past two years (averaging $388 billion over 2022-2023, down 20% from $484 billion over 2020-2021), while underwriting spreads have compressed. This is the reason—too much market competition and challenging business profitability—why both Citigroup Inc. and UBS Group AG announced plans to exit the municipal bond underwriting market at the end of last year.

Anecdotal evidence

Notwithstanding such market reality, anti-EDEA groups have pointed to anecdotal evidence to show that Oklahoma municipal borrowers are now, indeed, paying more for financing. One oft-repeated story over the past year has revolved around the City of Stillwater being forced to pay 70 basis points more for a $13.5 million loan to finance an energy efficiency project (LED streetlights and government building HVAC units) contracted with Johnson Controls International plc (JCI)—all because the city was precluded from doing business with its house bank BAC, even though the blacklisted lender had the lowest bid. Over the term of the planned loan, this would have equated to $1.2 million of additional interest cost for the infrastructure project. Notably, the Stillwater financing anecdote was cited in both the ORA study and the Keenan lawsuit challenging the EDEA.

Replacement with an Oklahoma bank

The story doesn’t hold water. First, Stillwater is a highly rated municipality with AA- general obligation bond ratings from both S&P Global Ratings and Fitch Ratings. Second, the city’s finances were able to weather a sharp increase in base interest rates during 2023, with the yield on the 10-year U.S. Treasury bond jumping by 168 basis points between April and October. Third, Stillwater enjoys ample financial flexibility and should not be overly dependent on any one particular financial institution (or market or instrument for that matter).

Lastly, over the same 2023 timeframe, the city was able to replace BAC with an Oklahoma bank for the equipment financing of two new firetrucks without missing a beat, so it is unclear why this energy efficiency contract was so problematic from a financing perspective. A 70-basis-point increase in annual interest cost should not be enough to cancel any infrastructure project unless the project’s economics were already challenged to begin with. In the Stillwater project postscript, the JCI contract and related BAC financing, which were originally approved in April 2023 just before the initial EDEA list was released, were officially cancelled in August 2023 when the City Council opted to take the energy savings project in-house and use city workers to cut costs.

Does the anti-ESG law really force a movement of funds?

The same hearsay approach—seemingly large numbers provided without context—has also been used to argue that the EDEA is negatively affecting Oklahoma’s public pension funds by forcing retirement accounts to move their investment management business from the currently banned buy-side firms. Based on estimates prepared by the Oklahoma Public Employees Retirement System (OPERS), the cost to the state pension system of re-contracting out its current BLK and STT portfolio allocations would approximate $10 million, with this $10 million number figuring prominently in the Keenan legal filing.

Addressing the fear, uncertainty and doubt

While scary on its face, a little analytical digging quickly removes the fear factor. First, $10 million of incremental (and importantly, one-time) administrative costs spread out over an OPERS portfolio with a market value of $11.7 billion as of June 30, 2023, equates to only 8 basis points, which is a rounding error in terms of net investment performance. That said, even $10 million of estimated breakage costs seems high, given that OPERS paid out $10.9 million in total investment management fees for the full 2023 fiscal year.

Since approximately 70% of the OPERS portfolio is currently passively invested, finding replacements for BLK and STT should not present a problem, although any OPERS investment contracts signed going forward should be looked at closely for unnecessary lock-up terms and termination costs (which may be the reason for the inflated $10 million EDEA compliance estimate). For proper perspective, the OPERS pension fund posted a total return of -14.5% during fiscal year 2022, losing $1.8 billion of market value when the U.S. debt and equity markets both traded down sharply in the wake of the shift in monetary policy by the Federal Reserve. Market beta is the main risk to OPERS portfolio performance and pension plan beneficiaries, not the drag from investment management fees (whether recurring or not).

Everything but the kitchen sink

Lastly, the Keenan lawsuit employs a kitchen-sink strategy to allege that the EDEA represents a breach of fiduciary responsibility by imposing a “political agenda” on Oklahoma’s public pension system, violating the U.S. Constitution’s First Amendment and the Oklahoma Constitution to boot. In the latter case, it is a statutory requirement that the OPERS system must be managed for the “exclusive benefit” of its plan participants and beneficiaries. Here, the anti-EDEA side is turning the legitimate criticism of ESG—that it is progressive politics masquerading as financial risk management and investment policy—on its head by arguing that the anti-ESG is the real political threat to free markets, fiduciary duty and pecuniary interest, which is quite rich.

Many of the firms involved are “woke”

In this regard, the OPERS Board of Trustees has noted that the pension fund’s primary goal is financial return—“providing benefits to participants and their beneficiaries and defraying reasonable expenses”—and does not factor ESG considerations into its investment philosophy or manager selection process. However, this ignores the fact that many Wall Street buy-side firms (including BLK and STT) are members of the United Nations’ Principles for Responsible Investment (PRI) and already integrate ESG factors into all their legacy commingled funds, both active and passive.

Moreover, many of these same asset managers are also members of various net-zero-driven climate alliances, most of which are closely aligned with the PRI. Even if ESG is not an explicit part of an investment management contract, asset owners such as OPERS are potentially exposing their portfolio performance to a sustainable investing framework and allowing their capital to be leveraged for ESG engagement purposes—both of which are problematic from a fiduciary perspective—unless their outsourced assets are tightly ring-fenced.

The anti-ESG law could be improved

None of this is to say that Oklahoma’s EDEA cannot be improved. But while there is room for better wordsmithing to remove legal ambiguity, this does not mean that Oklahoma Republicans should cave to the opposition by rewriting the EDEA to carve out local municipalities. Such a move would gut the anti-ESG law. Granting EDEA exemptions without proper due diligence, which has been the case up until now, is effectively the same thing. Notably, Oklahoma Attorney General Gentner Drummond offered an EDEA exemption for Stillwater’s $13.5 million cause celebre infrastructure project and simply accepted the $1.2 million incremental interest number at face value. If anti-ESG legislation is going to be part of the red state playbook, then Republicans need to do their financial homework when the political opposition starts to push back with specious analysis and vacuous numbers.

Given the weakness of the other side’s argument and the flawed data being used to back it up, now is not the time for anti-ESG supporters in Oklahoma to go wobbly and shrink from the political fight. A good rule of thumb is that when ESG progressives start complaining about government spending and defending free market capitalism and fiduciary responsibility, it usually means that conservative anti-ESG lawmakers are over the target.

This article was originally published by RealClearEnergy and made available via RealClearWire.

Paul Tice is a senior fellow at the National Center for Energy Analytics, an adjunct professor of finance at New York University’s Stern School of Business, and the author of The Race to Zero: How ESG Investing Will Crater the Global Financial System.

-

Civilization3 days ago

Civilization3 days agoWhy Europe Shouldn’t Be Upset at Trump’s Venezuelan Actions

-

Executive4 days ago

Executive4 days agoHow Relaxed COVID-Era Rules Fueled Minnesota’s Biggest Scam

-

Christianity Today3 days ago

Christianity Today3 days agoSurprising Revival: Gen Z Men & Highly Educated Lead Return to Religion

-

Civilization4 days ago

Civilization4 days agoThe End of Purple States and Competitive Districts

-

Executive4 days ago

Executive4 days agoWaste of the Day: Can You Hear Me Now?

-

Executive5 days ago

Executive5 days agoWaste of the Day: States Spent Welfare in “Crazy Ways”

-

Civilization1 day ago

Civilization1 day agoWhy Europe’s Institutional Status Quo is Now a Security Risk

-

Civilization2 days ago

Civilization2 days agoDeporting Censorship: US Targets UK Government Ally Over Free Speech