Executive

End the Discrimination Against Seniors

Working seniors would benefit the most from health savings accounts, and might show that appreciation at the polls.

The recent Democratic National Convention featured two themes of interest to working seniors: choice is an essential function of freedom, and every person should have access to affordable healthcare. Unfortunately, nobody at the convention, including V.P. Harris, expounded on those themes.

Working seniors have no savings – that’s why they’re working

At the intersection of these themes is Medicare for working seniors – a group for whom anxiety about healthcare affordability and limited choice is an ever-present reality. Considering the 2024 presidential election is expected to be competitive and close, both candidates should be competing for seniors’ votes.

Among the top 15 states with the highest number of working seniors, six are swing states (PA, MI, NC, GA, VA, and AZ). Not to be overlooked, two other swing states – NH and WI – rank in the top 15 states with the highest percentage of working seniors aged 65 or older. Each state has enough working seniors that one or two critical policy issues of interest to them likely would have changed the balance of the 2020 elections and will impact the outcome of the 2024 elections.

Among seniors, the working poor need more options. They are not working because they want to but rather out of necessity, having little or no retirement savings. In their world, upon retirement, they become insurance poor with their social security and minimal savings consumed by auto, health, and property insurance each month, leaving almost nothing to survive on.

Even those who aren’t working poor are concerned about the viability of their savings relative to the significant inflation and volatility in the market over the last four years. The average senior on Medicare pays $6,000 in annual deductibles and out-of-pocket medical expenses.

Why not let them have Health Savings Accounts?

There is electoral gold to be had for the candidate who proposes making Health Savings Accounts available to seniors.

Medicare is and always will be an important lifeline for more than 64 million people. But we all know it can and should be improved. The federal government wastes, mishandles, inefficiently utilizes or loses to fraud significant sums. Anything that shifts control of that money from the government to the people who need it is an improvement. Health Savings Accounts would give seniors more control of their Medicare funds. I’m confident seniors closely monitoring and guarding their Medicare dollars would significantly reduce waste, fraud, abuse and inefficiencies, saving them and the government precious resources.

Currently, Americans on Medicare are among the groups legally prevented from enjoying the benefits of this kind of tax-free savings account. You can have a Health Savings Account if you’re under 65, but when you enroll in Medicare, you can no longer make contributions. That’s discriminatory and punitive, and ending the policy should be common sense.

Making seniors eligible for Medicare Health Savings Accounts would provide them with a new and better Medicare option, that offers the same freedom (making their own decisions about their health care) that all eligible Americans who are under age 65 enjoy. Health Savings Accounts for working seniors on Medicare would give them greater choice, flexibility, control, and peace of mind.

How it works for you

The money in the account is yours. You own it. You control it. You can spend it on any healthcare item or service you prefer. And it’s never taxed. The money rolls over year to year so that it can grow tax-free. You can keep it as a rainy-day fund or even invest it in, for example, a mutual fund of your choice. And when you die, you can leave the money to your loved ones.

Consider the benefits if you’re a senior on Medicare: You can use your Health Savings Accounts to pay for things Medicare doesn’t cover, like dental care, eyeglasses, smoking cessation, weight-loss programs, etc. And if you’re low-income, Medicare will fund the account for you.

That last point is the key to the power of the Health Savings Accounts. When people spend their own money, they spend more carefully and waste less. This fact is well-documented, going back to national studies done by the Rand Corporation in the 1970s. Just think of buying a meal on an expense account – you would order differently than if you were paying for it yourself.

Do seniors a favor, and they will repay it

If for no other reason than political self-interest, both parties should be racing to formulate a plan for providing working seniors with Medicare eligibility to contribute and utilize Health Savings Accounts. It’s the right thing to do, and it just may be the policy issue that determines the next election.

It’s time to let seniors save tax-free for their health care, just like other Americans.

This article was originally published by RealClearHealth and made available via RealClearWire.

Martin Hoyt is the Director for Public Health Reform Alliance, a nonpartisan organization committed to increasing transparency and oversight on the public health system so it works better for all Americans.

-

Civilization4 days ago

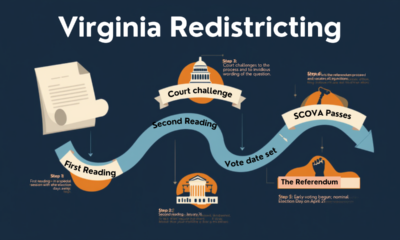

Civilization4 days agoVirginia redistricting – the forgotten theater

-

Civilization11 hours ago

Civilization11 hours agoThe U.S. and Australia Must Lead the Critical Minerals Race

-

Civilization4 days ago

Civilization4 days agoWhat the Political Attacks on Fetterman Reveal

-

Clergy4 days ago

Clergy4 days agoDecapitating Amalek: Iran, Purim, and the Obligation to Act in Time

-

Education23 hours ago

Education23 hours agoWaste of the Day: Boston’s Soccer Stadium Cost Almost Tripled

-

Executive3 days ago

Executive3 days agoWaste of the Day: Rhode Island Overtime Payments Approach $300,000

-

Civilization3 days ago

Civilization3 days agoIran: A Humbling Reminder of the Public Square We Take for Granted

-

Civilization1 day ago

Civilization1 day agoU.S.-Israel Joint Action Against Iran Is Just and Necessary