Constitution

Another Case Study for Reining In Presidential Authorities

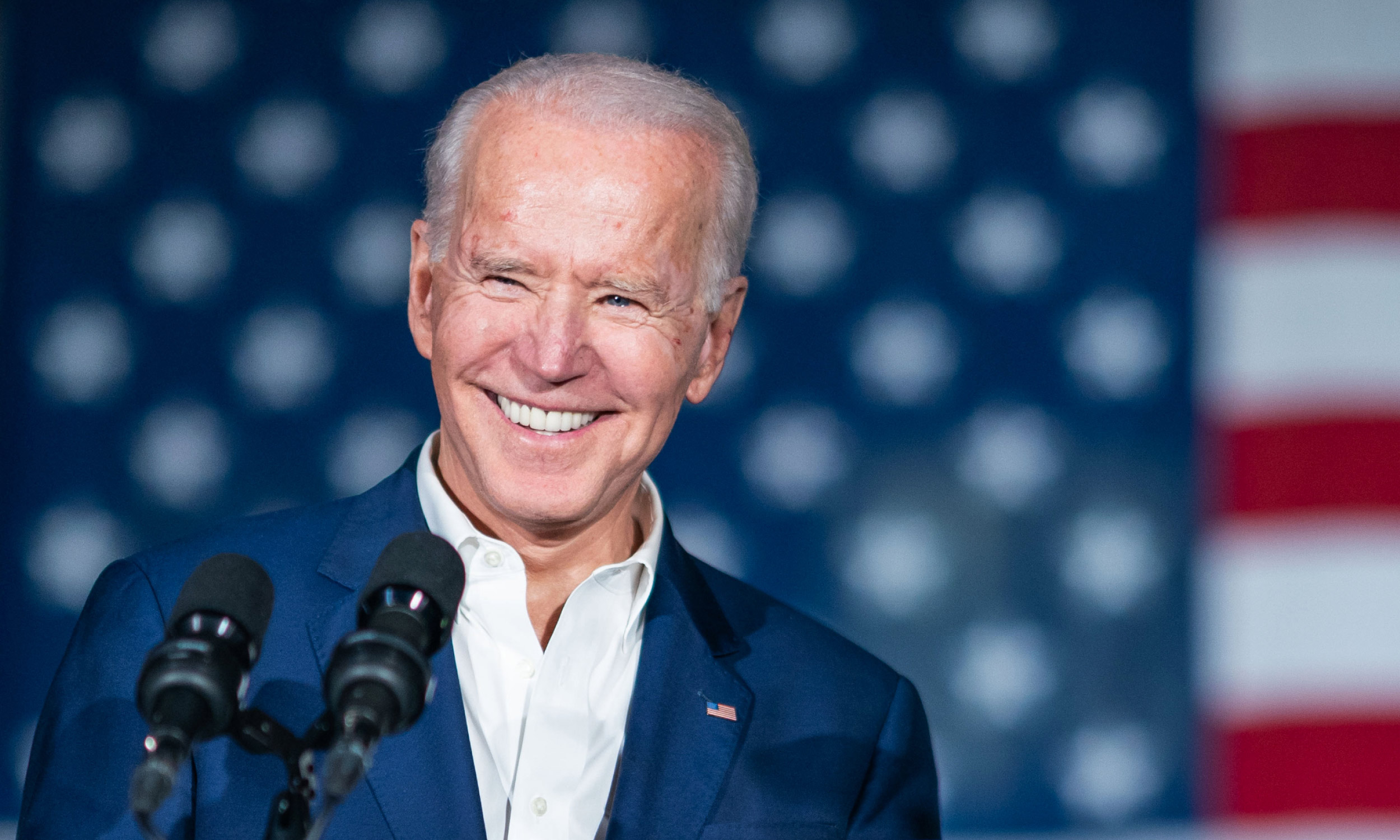

President Biden is clearly abusing his authority in his last days, but Congress should set limits on that authority.

As the new session of Congress begins, outgoing President Biden has chosen to continue pulling the levers of private enterprise even after the American people resoundingly rejected his administration and the Democratic Party’s bloated spending, excessive regulation, and politicization of business. With one foot out the door, the president recently blocked the acquisition of U.S. Steel by Japanese firm Nippon Steel, using the unwieldy powers granted to him as president.

By what authority?

The waning hours of the Biden administration continue to seize the headlines even after the president chose not to seek reelection, following an abysmal debate performance and evident age-related complications. In addition to the Nippon Steel decision, Biden pardoned a number of federal death row inmates, sought to sell off border wall construction materials, and prohibited new offshore oil and gas drilling in federal waters. While most Americans turn their attention to incoming – and returning – President Donald Trump, the current occupant of the White House continues to remind us who’s currently boss.

Presidential authority in the United States is, nevertheless, a bipartisan problem. Although Trump will likely take a friendly approach to oil and gas drilling, corporate mergers and acquisitions, and even tech, the new president will not be without his grudges and has already made it clear he intends to protect American jobs and workers by levying new tariffs on international trade. On the campaign trail, Trump shared Biden’s (and Harris’) opposition to the U.S. Steel acquisition on “national security” grounds. And both sides criticized deals like Nippon using patriotic rhetoric while offering little in the way of real solutions.

In fact, the Nippon debacle offers an early glimpse into how the new administration’s trade and foreign investment policies may take shape – hinting at the president’s growing personal influence over U.S. economic policy.

What authority does a President have?

The president has significant authority over foreign direct investment through the Committee on Foreign Investment in the United States, an interagency body within the executive branch that reviews foreign acquisitions of American companies to address national security risks. Even when the committee is unable to determine whether or not an acquisition constitutes a national security threat, as in the Nippon deal, the president still has the authority to block or unwind the transaction. When it comes to trade, the president holds powerful tools to shape U.S. policy without waiting on Congress. Invoking trade laws from the 1960s and 70s, the president can impose tariffs to shield American industries or hit back at foreign governments for bad behavior in global markets.

These outsized powers extend far beyond the checks and balances of America’s founding. Although the presidential veto was created to give the president a check over bad legislation, the United States should not leave our lone executive with the power to upset lawful business activity. The rapid shift towards politicized, unsubstantiated economic policy decisions is out of step with consumer sentiment and workers’ interests. In addition to internal dissent to Biden’s Nippon decision, the steelworkers at U.S. Steel themselves vocally supported the acquisition. By and large, a majority of Americans object to Trump enacting new tariffs if they will result in higher prices (as research studies suggest).

Congress must act

Certainly, both the Nippon acquisition and U.S. trade policy are complex issues affecting critical industries, jobs, and even security-related fields. Public opinion can only capture one side of these issues. But with national security arguments seemingly null and Trump exaggerating tariffs’ true impact, it’s hard to support leaving the ultimate jurisdiction over foreign direct investment and trade barriers in the hands of one person. Narrower concerns with labor displacement, job creation, China’s intellectual property theft, or other industrial competitiveness can be addressed through diplomatic negotiations and legislative proposals.

The incoming House and Senate should pay careful attention to the evolving abuse of presidential powers and how it has distorted markets for political gamesmanship. In a bipartisan consensus, legislators can return decisions to the people – via Congress – by reforming dated laws on foreign direct investment and tariffs. By reining in the presidency, Capitol Hill will bring these heated issues of security and business to the public square and let voters weigh in. As the Chevron decision reverts unruly powers of the bureaucracy back to Congress, lawmakers should temper down the scope and influence of the Oval Office.

This article was originally published by RealClearPolitics and made available via RealClearWire.

Sam Raus, a recent graduate of the University of Miami, is a Tech and Consumer Freedom fellow with Young Voices.

-

Accountability2 days ago

Accountability2 days agoWaste of the Day: Principal Bought Lobster with School Funds

-

Constitution2 days ago

Constitution2 days agoTrump, Canada, and the Constitutional Problem Beneath the Bridge

-

Executive23 hours ago

Executive23 hours agoHow Relaxed COVID-Era Rules Fueled Minnesota’s Biggest Scam

-

Civilization22 hours ago

Civilization22 hours agoThe End of Purple States and Competitive Districts

-

Civilization4 days ago

Civilization4 days agoThe devil is in the details

-

Executive4 days ago

Executive4 days agoTwo New Books Bash Covid Failures

-

Civilization4 days ago

Civilization4 days agoThe Conundrum of President Donald J. Trump

-

Executive4 days ago

Executive4 days agoThe Israeli Lesson Democrats Ignore at Their Peril