Executive

Trump Should Approach Improved Trade Ties With Russia With Caution

President Trump is dangling improved trade relations in front of Russia in a bid for peace. Would that be worth the risk?

After a feverish week of negotiations, President Trump’s efforts to facilitate an end to the Russian war against Ukraine have entered a crucial crossroads.

Trump offering Russia entry into U.S. markets

Showcasing a potential carrot, President Trump recently noted Russia would like “to get a piece” of the U.S. economy.

In Alaska, Vladimir Putin himself touted the prospect of expanded business partnerships with the U.S. including in the Arctic.

The administration, however, should proceed with caution.

Easing sanctions, let alone opening the American economy to Putin’s regime would be a tremendous concession, and one very likely to boomerang against the U.S.

Moscow needs Western technology to fully unlock the value of its resources.

Yet for American companies willing to wade in, returns would likely prove lackluster while carrying broader geopolitical risk.

In the Arctic, Russia remains highly reliant on outside technical expertise to drive its resource extraction projects. An inability to access western financing and technology, combined with sanctions have forced Russia to limit its once boundless Arctic LNG ambitions.

In aviation Russia is similarly reliant, grounding over half of its Airbus fleet due to a lack of parts and components. This despite importing $1.2 billion in spare Airbus and Boeing parts via sanctions loopholes and third party transit nations.

Historically, Russia has not been a significant trading partner for America. In 2021, the U.S. exported only $6.4 billion worth of goods to Russia, importing $29.7 billion. Conversely, that same year, the U.S exported $151 billion worth of goods to China and imported $504 billion.

When U.S. trade with Russia plummeted by 90 percent after Putin’s full-scale invasion, the American public hardly noticed.

Russia offers little that the U.S. could want

Even if you squint, it is hard to imagine U.S.-Russian trade booming anytime soon.

Russia simply does not produce much that the U.S. either cannot produce on its own or cannot obtain elsewhere.

For example, while Russia accounts for 24 percent of the enriched uranium the U.S. utilizes for civilian reactors, it hardly controls the market. Even on chemical fertilizers where the U.S. still imports heavily from Russia; the U.S. could, in a pinch rely on alternative suppliers like Canada to help fill any gaps.

John McCain’s famous description of Russia as “a gas station masquerading as a country” still holds true, while appreciating the other important mineral deposits Russia owns.

That, however, has long been the case. During the Cold War, the U.S. secretly bought up the titanium ore needed to build the SR-71 blackbird from the Soviet Union using shell companies and bogus end use certificates.

Despite these resources, there is little appetite amongst American companies to re-enter Russia. An authoritarian state with an ethos of chronic corruption is not an appealing market.

Last year, Transparency International ranked only twenty-three countries more corrupt than Russia, places like Afghanistan, North Korea, and Yemen.

Risks of asset seizure, and to reputation

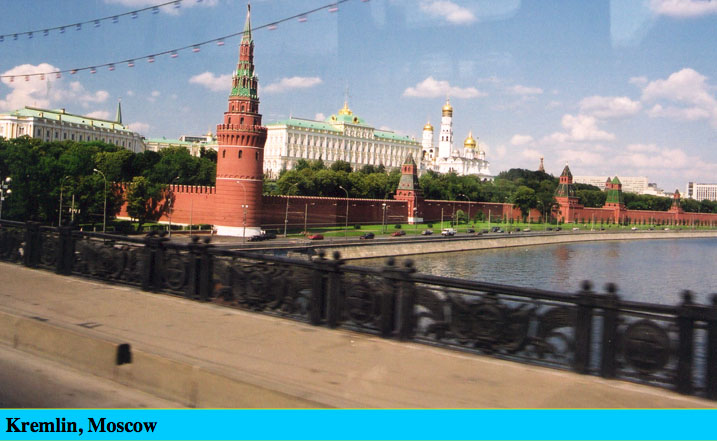

Doing business in Russia remains a perilous enterprise. Russia has put in place stringent caps on foreign ownership, and the ever-present threat of asset seizure by the Kremlin would remain a knife at the throat of U.S. businesses operating there.

There is also significant reputational risk to any U.S. company considering Russian re-engagement. A spring poll found that only 3 percent of Americans view Putin positively.

Recognizing that reality, a former Russian deputy finance minister recently noted, “Stopping the war itself does not significantly reduce the level of political risks.”

Even if thawing U.S.-Russian relations opened a window, the precariousness of the moment would discourage most American companies from seizing it.

Even on crucial rare earth minerals, the possibilities are muted. Despite the world’s fifth-largest reserves, last year Russia produced less than 1 percent of the global total, only slightly more than Madagascar, and far less than China or the U.S.

A harsh climate, stifling business environment, and long wait time for any return would do little to convince U.S. investors to jump into Russian rare earth extraction.

That of course would do little to alleviate the concerns around processing, where China retains a stranglehold with 92 percent of refining capacity.

Better to develop resources domestically or buy them from allied powers

Considering the stakes and time horizons, U.S. businesses would be far better off betting on new projects to supply these vital components of modern life either inside the U.S. or on allied territory, rather than helping build an adversary’s capacity.

Even if an agreement between Ukraine and Russia is reached, Putin will continue to build up his arsenal facing the West.

Rather than infuse the Russian economy with the legally obtained Western technology and materiel it needs to continue its military buildup and pacify its elite population, the U.S. is more likely to bring about lasting peace by treading carefully.

Today as throughout history, the lure of Russia for U.S. businesses remains a mirage. Moscow desperately desires access to Western capital and technology but in the end offers little in return.

This article was originally published by RealClearWorld and made available via RealClearWire.

Daniel Kochis is a Senior Fellow in the Center on Europe and Eurasia at Hudson Institute

-

Accountability2 days ago

Accountability2 days agoWaste of the Day: Principal Bought Lobster with School Funds

-

Constitution2 days ago

Constitution2 days agoTrump, Canada, and the Constitutional Problem Beneath the Bridge

-

Executive21 hours ago

Executive21 hours agoHow Relaxed COVID-Era Rules Fueled Minnesota’s Biggest Scam

-

Civilization20 hours ago

Civilization20 hours agoThe End of Purple States and Competitive Districts

-

Civilization4 days ago

Civilization4 days agoThe devil is in the details

-

Executive4 days ago

Executive4 days agoTwo New Books Bash Covid Failures

-

Civilization3 days ago

Civilization3 days agoThe Conundrum of President Donald J. Trump

-

Executive4 days ago

Executive4 days agoThe Israeli Lesson Democrats Ignore at Their Peril