Executive

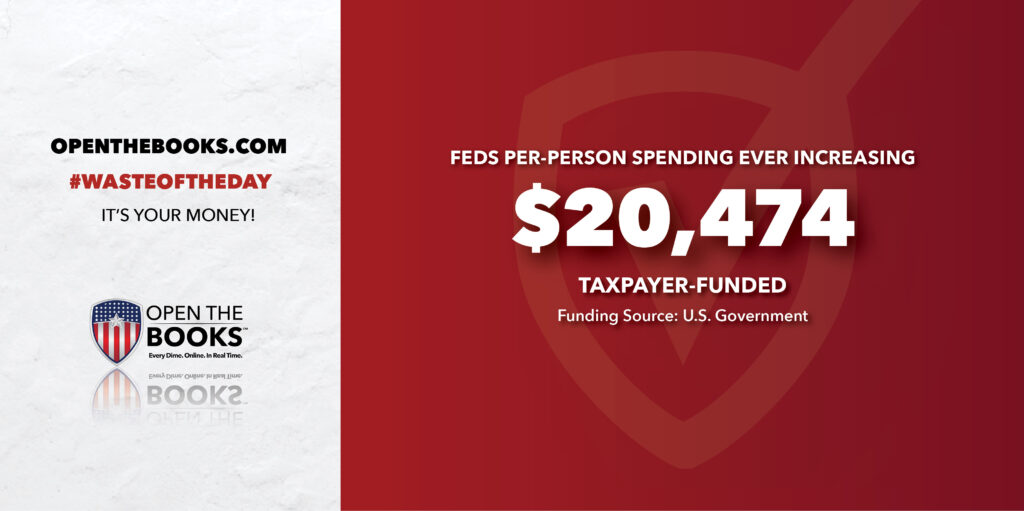

Waste of the Day: Outlays Per Person Up Nearly 100X Since 1916

Government spending has increased far faster than either inflation or population growth, with spending per person up 100 times in 100 years.

Topline: Almost everyone knows that government spending has been increasing for years, but it can’t all be blamed on inflation and population growth. Historical data reviewed in a new Open the Books report shows that outlays per person have increased nearly 100 times since 1916, when it was a mere $208.36 per person adjusted for inflation.

How government outlays per capita have increased

Key facts: The federal government spent $7.035 trillion in fiscal year 2025. Divided by the more than 343.6 million people currently in the country, that’s $20,474 in spending per person. It was slightly lower in fiscal year 2024, with $20,449 spent per person.

For comparison, the average annual mortgage payment for a house was under $28,000 in 2025. The Department of Agriculture estimated a family of four spenda $12,000 to $20,000 annually on groceries.

Both of those basic needs are far surpassed by federal spending.

Government spending per person was only higher during the Covid-19 pandemic from 2020 to 2022. The current spending rate is more than $3,000 per person more expensive than in any year before 2020, adjusted for inflation.

At the height of World War II in 1944, the government spent $12,679 per person in the U.S., adjusted for inflation.

Search all federal, state and local salaries and vendor spending with the world’s largest government spending database at OpenTheBooks.com.

Background: Total federal spending has increased slightly since Donald Trump took office this January. Decreased spending at agencies such as the Department of Education and Small Business Administration was offset by higher outlays at the Departments of Defense and Veterans Affairs, and decreased corporate income tax revenue. In the end, the 2025 federal deficit was $1.8 trillion, nearly identical to 2024.

Borrowing without limit

Of course, the deficit has forced the government to borrow cash from foreign governments with seemingly no limit. Washington borrowed $572.8 billion this July, more than any other month in history besides the first few months of the pandemic.

As the national debt grows, the government must spend more to pay it back with interest, creating a cycle of excessive spending. Interest cost the government $91 billion this October, the first month of fiscal year 2026. Only Medicare, Social Security and defense spending cost more. October interest payments were $80 billion or lower in each of the previous five years.

The Peter G. Peterson Foundation notes that, at this rate, interest will cost 3.2% of the nation’s gross domestic product in 2026, breaking the previous record set in 1991.

Summary: Increased government spending per person over the last century can partially be attributed to vital programs like food stamps and Social Security. Still, not all would agree that high taxes and debt are worth having more government agencies than any American can even name.

The #WasteOfTheDay is brought to you by the forensic auditors at OpenTheBooks.com.

This article was originally published by RealClearInvestigations and made available via RealClearWire.

Jeremy Portnoy, former reporting intern at Open the Books, is now a full-fledged investigative journalist at that organization. With the death of founder Adam Andrzejewki, he has taken over the Waste of the Day column.

-

Civilization5 days ago

Civilization5 days agoWhy Europe Shouldn’t Be Upset at Trump’s Venezuelan Actions

-

Christianity Today5 days ago

Christianity Today5 days agoSurprising Revival: Gen Z Men & Highly Educated Lead Return to Religion

-

Civilization2 days ago

Civilization2 days agoTariffs, the Supreme Court, and the Andrew Jackson Gambit

-

Civilization3 days ago

Civilization3 days agoWhy Europe’s Institutional Status Quo is Now a Security Risk

-

Civilization4 days ago

Civilization4 days agoDeporting Censorship: US Targets UK Government Ally Over Free Speech

-

Executive3 days ago

Executive3 days agoWaste of the Day: Wire Fraud, Conflicts of Interest in Connecticut

-

Civilization3 days ago

Civilization3 days agoEpstein and the destruction of trust

-

Education4 days ago

Education4 days agoWaste of the Day: Throwback Thursday – The Story of Robosquirrel