Accountability

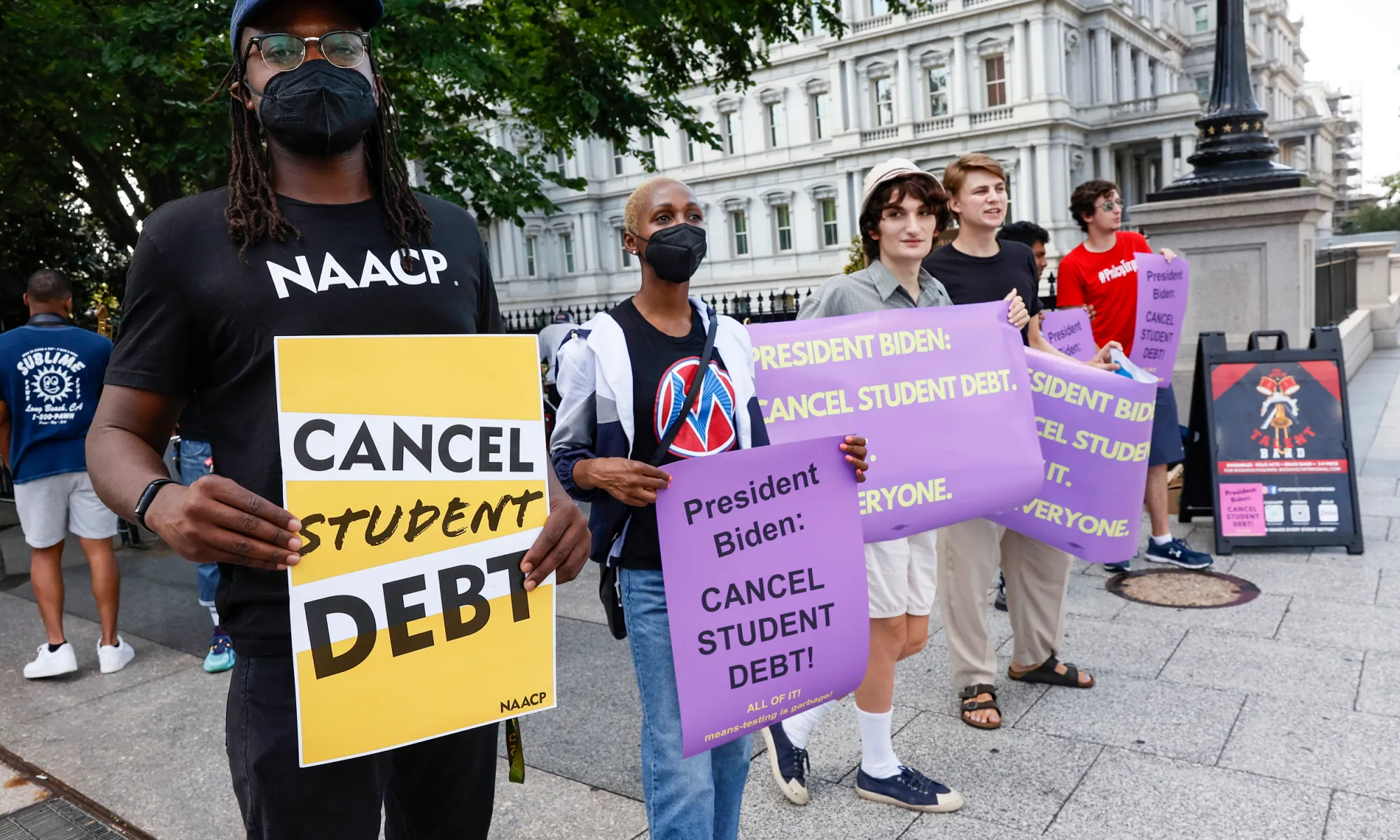

Borrowers who receive federal loan forgiveness may owe taxes on it in some states

Some states may tax the recipients of President Biden’s federal student loan forgiveness program due to laws on the books that tax forgiven loans as income.

Several states will be taxing federal student loan recipients who get $10,000-20,000 of their federal student loans forgiven unless their state governments can move to change the tax laws in time. Arkansas, Mississippi, Minnesota, North Carolina, and Wisconsin all currently have laws that would count any amount of a loan forgiven as taxable income, according to the Tax Foundation.

“As a general rule, a discharge of indebtedness counts as income and is taxable,” said Will McBride explains. “Under § 9675 of the American Rescue Plan Act (ARPA), however, the forgiveness of student loan debt between 2021 and 2025 does not count toward federal taxable income. States which follow the federal treatment here will likewise exclude debt forgiveness from their own state income tax bases. But, for a variety of reasons, not every state does that.”

Of the states in question, only some have committed to making changes to their tax laws that would prevent federal loan forgiveness recipients from owing taxes on their canceled loan amounts. Leaders in Minnesota and Wisconsin have said they will move to change the laws, and in others, lawmakers have expressed they would consider it.

“I’m sure people will want to look at adjusting that or making some changes in the law, but a lot of factors have to be considered,” Mississippi State Senator Josh Harkins (R-Brandon) said to PBS. “This all just hit in the last week.”

Terry A. Hurlbut has been a student of politics, philosophy, and science for more than 35 years. He is a graduate of Yale College and has served as a physician-level laboratory administrator in a 250-bed community hospital. He also is a serious student of the Bible, is conversant in its two primary original languages, and has followed the creation-science movement closely since 1993.

-

Civilization4 days ago

Civilization4 days agoWhy Europe Shouldn’t Be Upset at Trump’s Venezuelan Actions

-

Christianity Today4 days ago

Christianity Today4 days agoSurprising Revival: Gen Z Men & Highly Educated Lead Return to Religion

-

Executive5 days ago

Executive5 days agoWaste of the Day: Can You Hear Me Now?

-

Civilization2 days ago

Civilization2 days agoTariffs, the Supreme Court, and the Andrew Jackson Gambit

-

Civilization2 days ago

Civilization2 days agoWhy Europe’s Institutional Status Quo is Now a Security Risk

-

Civilization3 days ago

Civilization3 days agoDeporting Censorship: US Targets UK Government Ally Over Free Speech

-

Executive3 days ago

Executive3 days agoWaste of the Day: Wire Fraud, Conflicts of Interest in Connecticut

-

Civilization3 days ago

Civilization3 days agoEpstein and the destruction of trust

Actually, every State that has an income tax and the Federal Government would have to consider this income. The borrowers are effectively being given money. The loans constitute specific Welfare which the Federal Government is not allowed to do. Welcome to the Constitutional issues that have been created for close to a century.