News

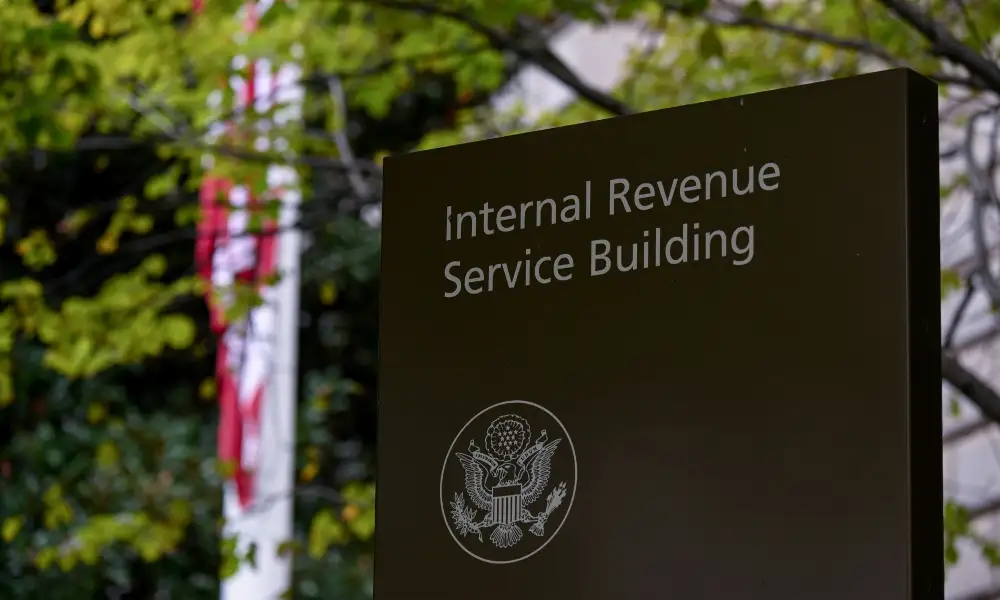

IRS announces it will refund $1.2 billion in penalties for those who filed late during pandemic

The Internal Revenue Service announced this week that it will refund millions of individual and business tax filers penalties they paid for filing their taxes late during the height of the coronavirus pandemic.

The announcement from the IRS details a plan to repay penalties collected from 1.6 million filers for 2019 and 2020 tax filings due to a backup caused by the pandemic that resulted in a major backlog in processing returns at the IRS.

The agency explains the COVID-19 pandemic had an “unprecedented effect on the IRS’s personnel and operations,” and that it was “called upon to support emergency relief for taxpayers, such as distributing economic impact payments,

3 while sustaining its regular operations in a pandemic environment with limited resources, where employees were sometimes unable to be physically present to process tax returns and correspondence.”

Recipients of the refund will not have to take any action in order to receive it. The funds will be automatically refunded to recipients and should be largely completed by the end of the month, according to the announcement.

“Besides providing relief to both individuals and businesses impacted by the pandemic, this step is designed to allow the IRS to focus its resources on processing backlogged tax returns and taxpayer correspondence to help return to normal operations for the 2023 filing season,” the IRS said.

Terry A. Hurlbut has been a student of politics, philosophy, and science for more than 35 years. He is a graduate of Yale College and has served as a physician-level laboratory administrator in a 250-bed community hospital. He also is a serious student of the Bible, is conversant in its two primary original languages, and has followed the creation-science movement closely since 1993.

-

Civilization5 days ago

Civilization5 days agoThe Theory and Practice of Sanctuary Cities and States

-

Civilization5 days ago

Civilization5 days agoAmerica Can’t Secure Its Future on Imported Minerals

-

Civilization5 days ago

Civilization5 days agoCompetition Coming for the SAT, ACT, AP, and International Baccalaureate

-

Civilization3 days ago

Civilization3 days agoThe Minnesota Insurrection

-

Civilization3 days ago

Civilization3 days agoSupreme Court Orders CA Dems To Justify Prop 50 Maps

-

Education2 days ago

Education2 days agoFree Speech Isn’t Free and It Cost Charlie Kirk Everything

-

Civilization2 days ago

Civilization2 days agoThe Campaign Against ICE Is All About Open Borders

-

Executive2 days ago

Executive2 days agoWaste of the Day: U.S.-Funded International Groups Don’t Have to Report Fraud