Money matters

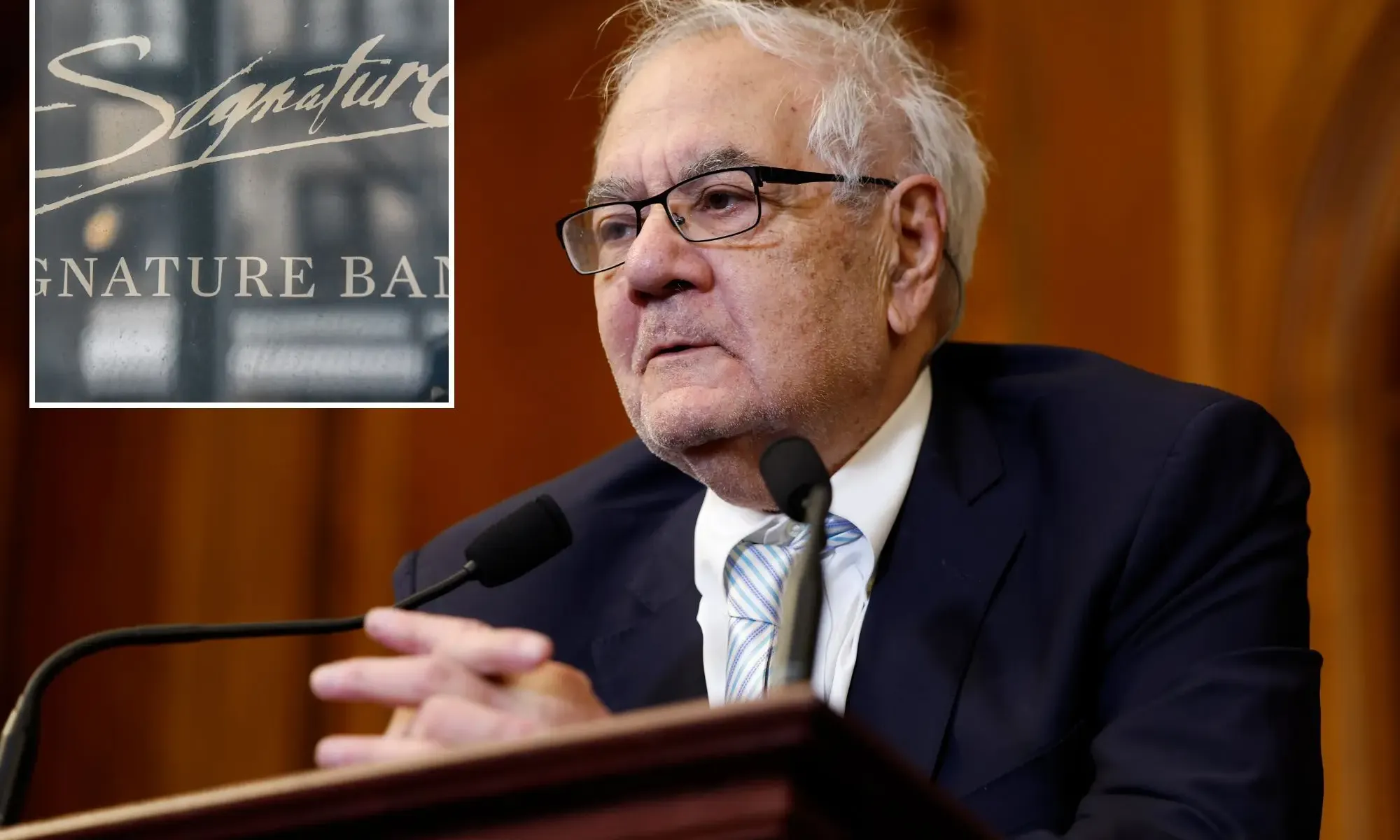

Barney Frank under fire over role on board of doomed Signature Bank

Retired congressman Barney Frank, who co-wrote the Dodd-Frank Act which aimed to fine tune bank regulations following the 2008 financial crisis, has come under fire amidst the latest banking collapse in The United States.

Barney is on the board of directors at Signature Bank, who are a New York lender that was shut down by state regulators over the weekend. Signature Bank became the 3rd bank to collapse following Silicon Valley Bank, which was shut down on Friday, and Silvergate Capital, which was shut down the previous week.

Frank spoke to Bloomberg on Friday and argued that some of the blame should lie with crypto currencies, which weren’t in existence when he and other lawmakers were dealing with the Lehman Brothers collapse in 2008.

“Digital currency was the new element entered into our system,” Frank told Bloomberg. “A new and destabilizing – potentially destabilizing – element is introduced into the financial system. What we get are three failures.”

Frank didn’t discuss crypto’s role in helping Signature Bank grow, despite concerns about its volatility.

Frank also insisted that regulators’ move to shut down Signature was hasty, claiming that the bank could have survived.

“I think that if we’d been allowed to open tomorrow, that we could’ve continued — we have a solid loan book, we’re the biggest lender in New York City under the low-income housing tax credit,” Frank said. “I think the bank could’ve been a going concern.”

“Mr. Frank’s extensive experience as a congressman, and particularly as Chair of the House Financial Services Committee, led the Board to conclude that he should be a member of the Board,” a statement about Frank’s appointment to the board reads.

As of February 2023, Frank owned 5,542 shares in Signature Bank, which at the time were worth $825,000. The value of the shares will have diminished following the bank entering administration.

-

Civilization1 day ago

Civilization1 day agoWhy Europe Shouldn’t Be Upset at Trump’s Venezuelan Actions

-

Accountability4 days ago

Accountability4 days agoWaste of the Day: Principal Bought Lobster with School Funds

-

Executive2 days ago

Executive2 days agoHow Relaxed COVID-Era Rules Fueled Minnesota’s Biggest Scam

-

Constitution3 days ago

Constitution3 days agoTrump, Canada, and the Constitutional Problem Beneath the Bridge

-

Christianity Today1 day ago

Christianity Today1 day agoSurprising Revival: Gen Z Men & Highly Educated Lead Return to Religion

-

Civilization2 days ago

Civilization2 days agoThe End of Purple States and Competitive Districts

-

Executive2 days ago

Executive2 days agoWaste of the Day: Can You Hear Me Now?

-

Executive3 days ago

Executive3 days agoWaste of the Day: States Spent Welfare in “Crazy Ways”