Executive

Iowa vs. Minnesota: The Future of State Fiscal Policy

Iowa and Minnesota present a controlled experiment in tax cutting, with Iowa as the experimental side. Results are overwhelmingly positive.

“A tax-cutting wave is sweeping over America’s states,” The Economist claims in a recent feature, and Iowa, it argues, has “emerged as America’s tax-cutting champion, a paragon of fiscal responsibility.”

Until recently, the Hawkeye State had some of the highest individual and corporate income tax rates in the nation, but, since 2018, Governor Reynolds has made tax reform a priority.

Iowa led the “tax-cutting wave” in 2022, with the most comprehensive and aggressive tax reform in the United States. This will gradually replace the nine-bracket, progressive income tax with a flat tax, bringing the top rate, which was close to 9 percent, down to a flat 3.9 percent by 2026. Not only will Iowa have eliminated the progressive income tax, it will also have but reduced the top tax rate by almost 60 percent.

Iowa’s corporate tax rate, once the highest in the nation at 12 percent, is also being cut: Starting in January 2024, the corporate tax rate will be 7.1 percent and the rate will continue to be lowered until it reaches a flat 5.5 percent.

Critics of Iowa’s fiscal reforms warn against alleged “economic recklessness.” Mike Owen, Deputy Director of Common Good Iowa, a progressive think tank, told The Economist that “a crash is coming” and that programs such as education and health care will suffer as a result.

This doesn’t add up. Thanks to fiscal prudence, Iowa’s budget is in strong shape. For the last few years Iowa’s budget has been in surplus, ending fiscal year 2023 with a $1.83 billion surplus, which was $86.3 million higher than originally estimated. The fiscal year 2024 surplus is projected to be $2.12 billion, rising to $2.99 billion in the fiscal year 2025.

Iowa’s reserve accounts (Cash Reserve Fund and Economic Emergency Fund) are filled at their statutory maximums and are projected to continue at this level in fiscal years 2024 ($961.9 million) and 2025 ($957.6 million). The surpluses have also fueled an enormous growth in the Taxpayer Relief Fund (TRF).

The legislature created the TRF to provide income tax relief. It has a current balance of $2.73 billion and this is projected to increase to $3.66 billion in fiscal year 2024 and $3.855 billion in fiscal year 2025. This represents not only an overcollection of taxpayer dollars, but it is a massive amount of dollars. In comparison Iowa’s fiscal year General Fund budget is $8.5 billion.

Iowa’s fiscal foundation would not be so strong if it were not for conservative budgeting. Iowa code limits the legislature to only spending 99 percent of estimated revenue, but in passing the fiscal year 2024 General Fund budget the legislature only spent 88.25 percent of projected tax collections. Critics point to lower revenue projections, but this is only because the tax cuts are being phased in. Revenues continue to remain strong in Iowa. “Every single time since we’ve cut taxes, revenues have still come in higher than estimates,” stated Iowa Senate Majority Leader Jack Whitver to The Economist.

Governor Reynolds is not just advocating tax cuts; she has also brought reform to state government: Limited government is not just a slogan for the Governor. In fact, she resembles the spirit of President Calvin Coolidge in her commitment to limited government. In addition to tax cuts and conservative budgeting, Governor Reynolds has reformed state government by reforming and reducing the state bureaucracy. Iowa once had 37 executive branch cabinet agencies which has now been reduced to 16 and further reforms will be considered during the next legislative session. Governor Reynolds has also launched an executive-led review of regulations in order to eliminate excessive and out-of-date regulations.

Whether it is pro-growth tax reform, conservative budgeting, or limiting the administrative state, Iowa is the national leader in state fiscal policy. Neither is Governor Reynolds going to be complacent. She understands the importance, not only of making Iowa the most competitive state, but of allowing taxpayers to keep more of their income. The Governor’s goal is to not only have the lowest state flat tax in the nation, but also eliminate the income tax.

The opposite is occurring in progressive states such as neighboring Minnesota. There, the DFL state government went into the last legislative session with a forecast budget surplus of $18 billion. Not only did they spend every cent of that, but they hiked taxes and fees by $10 billion on top of that. Indeed, Minnesota’s state government spending will be 33% higher in 2027 than it was in 2022.

While observers are quick to cry “Kansas” at tax cutting states, they do not do so to tax hiking ones like Minnesota. This is despite that fact that the new, ongoing spending in the Gopher State’s budget is funded by new taxes, such GILTI and on investment income, which are pro-cyclical: If the economy tanks, Minnesota’s budget is back in deficit.

Many progressive states that are following a policy agenda of high taxes and spending are not only confronted with fiscal crisis but are also experiencing a mass exodus as people and businesses flee their high tax rates. Census Bureau data show that, in 2022, Minnesota lost residents, on net to each of its neighbors, including Iowa. When people vote with their feet, they prefer what Governor Reynolds is offering in Iowa.

This article was originally published by RealClearPolicy and made available via RealClearWire.

-

Civilization3 days ago

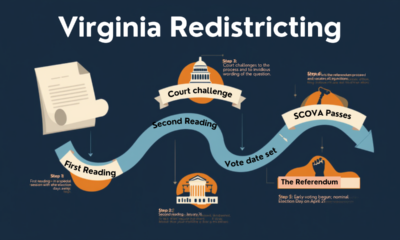

Civilization3 days agoVirginia redistricting – the forgotten theater

-

Education5 days ago

Education5 days agoWaste of the Day: DEI Contractors Remain in Military’s K-12 Schools

-

Civilization3 days ago

Civilization3 days agoWhat the Political Attacks on Fetterman Reveal

-

Civilization4 days ago

Civilization4 days agoTrump’s SOTU Speech a Win, But It’s Not Enough

-

Civilization5 days ago

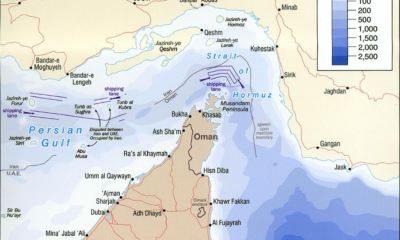

Civilization5 days agoAt a Time of International Turmoil, ARC-ES Can Bring Energy Stability to the U.S.

-

Clergy3 days ago

Clergy3 days agoDecapitating Amalek: Iran, Purim, and the Obligation to Act in Time

-

Civilization4 days ago

Civilization4 days agoTop Library Advocate: Backing Drag Queen Story Hour Supports Parental Choice

-

Executive2 days ago

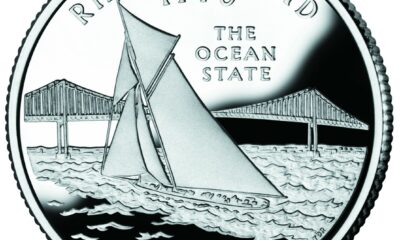

Executive2 days agoWaste of the Day: Rhode Island Overtime Payments Approach $300,000