Executive

Waste of the Day: Covid Lending Program Has $257 Million In Losses

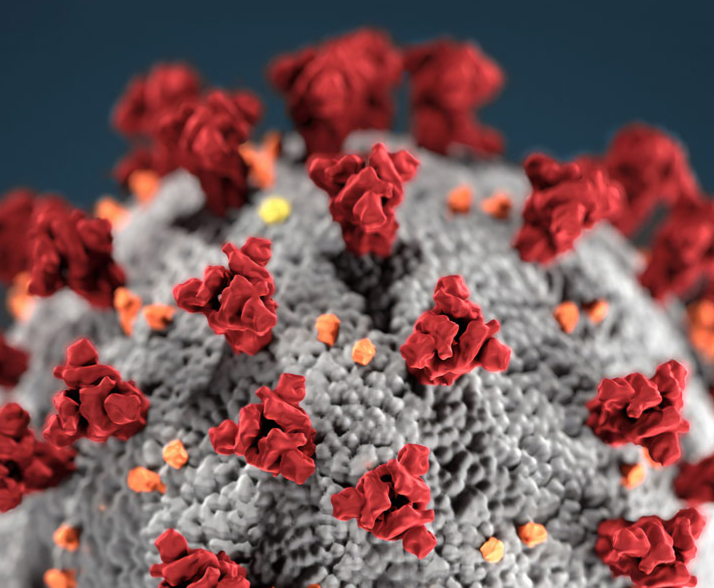

A program to lend money to idled businesses during Covid has lost $257 million so far, as people start missing payments.

Topline: A federal Covid-era lending program faces millions in losses, with past-due payments growing as small business borrowers face increased interest payments on the variable rate loans.

Key Facts: As of Sept. 30, 2023, the federal Main Street Lending Program had $257 million in actual loan losses, according to a U.S. Government Accountability Office report.

Since interest payments began in August 2021, most borrowers have been making them on time.

However, the rate of past-due payments increased to about 7.6 percent in August 2023 and could remain higher than average as borrowers face increased interest payments as variable rates on Main Street loans have risen.

The GAO found that 610 loans (or about 33%) had been fully repaid, and 45 loans (or about 2.5 percent) had recorded losses.

Background: Responding to the Covid-19 pandemic, the Federal Reserve System Board of Governors authorized 13 emergency lending programs for certain parts of the economy, including businesses and employers.

The Main Street Lending Program was for small and mid-sized businesses and nonprofits and ended on Jan. 8, 2021. The Federal Reserve implemented the emergency lending program to mitigate disruptions in credit for large and small businesses, as well as state and local governments, as a result of the pandemic.

The program provided loan for employers who had been in good financial standing prior to the onset of the pandemic. Employers who took the loans must have made “reasonable efforts to maintain payroll and retain workers.”

Larger businesses make up a large portion of the fully repaid loans, while loans with losses were proportionally higher for smaller businesses. For example, businesses that had 2019 gross revenue of $7.7 million or more accounted for the majority of fully repaid loans, as of August 2023. \

Critical Quote: “Small businesses’ access to credit has decreased since 2022, as banks have tightened credit standards in response to a less positive economic outlook and industry-specific problems,” the GAO said in its report.

“The Federal Reserve implemented the emergency lending facilities to mitigate disruptions in credit markets for large and small businesses, as well as state and local governments, as a result of the COVID-19 pandemic. We found that since the termination of the facilities, while uncertainties exist in credit markets, near-term default risks in the markets the facilities operated in appear to be low, as vulnerabilities also remain low.”

Summary: A program intended to help small and medium-size businesses during the pandemic may have been created out of relative goodwill but the variable rates on the loans will be no friend to the businesses that must pay them back.

The #WasteOfTheDay is brought to you by the forensic auditors at OpenTheBooks.com.

This article was originally published by RealClearInvestigations and made available via RealClearWire.

Adam Andrzejewski (say: Angie-eff-ski) is the CEO/founder of OpenTheBooks.com. Before dedicating his life to public service, Adam co-founded HomePages Directories, a $20 million publishing company (1997-2007). His works have been featured on the BBC, Good Morning America, ABC World News Tonight, C-SPAN, The Wall Street Journal, The New York Times, USA Today, FOX News, CNN, National Public Radio (NPR), Forbes, Newsweek, and many other national media.

Today, OpenTheBooks.com is the largest private repository of U.S. public-sector spending. Mission: post "every dime, online, in real time." In 2022, OpenTheBooks.com captured nearly all public expenditures in the country, including nearly all disclosed federal government spending; 50 of 50 state checkbooks; and 25 million public employee salary and pension records from 50,000 public bodies across America.

The group's aggressive transparency and forensic auditing of government spending has led to the assembly of grand juries, indictments, and successful prosecutions; congressional briefings, hearings, and subpoenas; Government Accountability Office (GAO) audits; Congressional Research Service (CRS) reports; federal legislation; and much more.

Our Honorary Chairman - In Memoriam is U.S. Senator Tom Coburn, MD.

Andrzejewski's federal oversight work was included in the President's Budget To Congress FY2021. The budget cited his organization by name, bullet-pointed their findings, and footnoted/hyperlinked to their report.

Posted on YouTube, Andrzejewski's presentation, The Depth of the Swamp, at the Hillsdale College National Leadership Seminar 2020 in Naples, Florida received 3.8 million views.

Andrzejewski has spoken at the Columbia School of Journalism, Harvard Law School and the law schools at Georgetown and George Washington regarding big data journalism. As a senior policy contributor at Forbes, Adam had nearly 20 million pageviews on 206 published investigations. In 2022, investigative fact-finding on Dr. Fauci's finances led to his cancellation at Forbes.

In 2022, Andrzejewski did 473 live television and radio interviews across broadcast, major cable platforms, and radio shows. Andrzejewski is the author of The Waste of the Day column at Real Clear Policy. The column is syndicated by Sinclair Broadcast Group, owners of nearly 200 ABC, NBC, CBS, and FOX affiliates across USA.

Andrzejewski lives in Hinsdale, Illinois with his wife Kerry and three daughters. He is a lector at St. Isaac Jogues Catholic Church and has finished the Chicago Marathon eight times (PR 3:58.49 in 2022).

-

Civilization5 days ago

Civilization5 days agoCHAPTER 12: Seeding Race Wars

Space Is No Longer the Final Frontier—Reality Is [forthcoming release May 2024] -

Constitution3 days ago

Constitution3 days agoPrecinct Strategy scores again

-

Education4 days ago

Education4 days agoTitle IX revision sparks State revolts

-

Civilization2 days ago

Civilization2 days agoLegacy media already assume Trump wins

-

Education5 days ago

Education5 days agoDid the Freemasons, Illuminati, Spiritualists and Mystics establish this country?

-

Civilization2 days ago

Civilization2 days agoSCOTUS Is Last Bulwark Against Critical Legal Studies

-

Education3 days ago

Education3 days agoThe Road Back to Normalcy Starts Where the Problem Began: College Campuses

-

Civilization2 days ago

Civilization2 days agoWhat 10 Years of U.S. Meddling in Ukraine Have Wrought (Spoiler Alert: Not Democracy)