Executive

The U.S. Could Take a Page from Australia’s Natural Gas Playbook

The U.S Government could do far worse than to look to Australia’s natural gas policy as it considers the future of LNG exports.

Australia and the U.S. lead in natural gas

Gas production from the U.S. and Australia is essential to global energy markets. Australia was the world’s leading LNG exporter in 2020 and 2021, a mantle the U.S. assumed in 2023.

But the LNG industry in both countries has faced great policy uncertainty in recent times. In the U.S., this arrived with the unexpected January announcement of a halt to pending LNG export approvals, while Australia’s policy environment has been clouded for several years by cumbersome regulatory processes that stifled project development.

The Future Gas Strategy released by the Australian Government in May addresses many of these concerns and establishes a roadmap future gas production investment. It outlines a clear role for gas in Australia’s energy transition, ensuring reliable power generation as major renewable energy projects are rolled out.

Critically, it identifies the vital long-term contribution that Australian LNG will make in ensuring energy security for traditional customers in Asia and supporting emerging nations in the region as they look to reduce their reliance on high-emitting coal.

While the Future Gas Strategy is underpinned by International Energy Agency (IEA) projections for global gas demand, it notes great variations between differing scenarios and early indications that real-life demand may exceed modelling. It acknowledges forecasts for much higher gas demand in Asia from reputable sources that know the region best, such as the Institute of Energy Economics, Japan.

The U.S. has been far less flexible

Thus far, flexibility around demand forecasts, including those of Asia, doesn’t seem to have had much of a place in dialogue around the U.S LNG export halt.

As the U.S Chamber of Commerce has identified, the Department of Energy has seemingly sidelined gas projections from the U.S. Government’s own Energy Information Administration to use IEA data. However, many of the IEA projections are not forecasts based on practical assessments of future need but instead work backwards from decarbonization targets.

Backcasting is not the same as providing accurate forecasts of future need on which to base energy policy.

While climate targets are necessary to deliver the Paris Agreement, backcasting fails to account for the energy realities of growing, emerging economies. This runs the risk of creating a future shortfall of low-carbon gas, forcing economies in Asia back to coal or creating energy insecurity.

Important climate objectives won’t be achieved if Asia’s growing coal use becomes even more entrenched. Global coal use reached record levels in 2023, with three out of every four tons consumed in India, China and Southeast Asia. Without sufficiently available and affordable volumes of LNG from a range of exporting countries, this pattern will be hard to break.

The Australian Future Gas Strategy reflects this, describing how “continued supply of LNG can reduce the carbon intensity of our region’s energy mix, including by replacing more emissions intensive fuels like coal.”

The carbon footprint

It also challenges the Australian gas industry to keep reducing its own carbon footprint, including through development of carbon capture and storage technology. I am sure Australian gas producers are up for that challenge, just as I know the U.S. gas industry is committed to doing everything within its power to address greenhouse gas emissions.

U.S. gas producers already operate under one of the world’s most comprehensive and stringent methane management frameworks, established by the Environmental Protection Agency.

A comprehensive recent study by the Berkeley Research Group, underpinned primarily by methane emissions data from operations, demonstrates U.S. LNG is far cleaner than the coal currently being used for power generation in Asia.

The U.S. gas industry and its customers right now are facing uncertainty, the enemy of long-horizon investments with major capital outlays, such as those into LNG. An open-ended halt to approvals makes long-term decision-making on LNG infrastructure all but impossible.

U.S. LNG has already showed it can be a force for good from an energy security perspective, stepping up to stabilize Europe’s energy systems after Russia’s invasion of Ukraine. It can be similarly beneficial for allies in Asia, ensuring supply diversity, along with availability and affordability of gas that coal-dependent emerging nations are actively seeking.

The U.S.A. should follow the lead of Australia

The Australian Government has now publicly recognized the global benefits of its natural gas.

By expeditiously resolving the halt, the Biden Administration can do likewise – giving U.S. LNG exporters and Asian trading partners the certainty needed to move rapidly towards an achievable low-carbon future, at scale and without killing economic opportunities.

This article was originally published by RealClearEnergy and made available via RealClearWire.

Paul Everingham is CEO of the Asia Natural Gas and Energy Association (ANGEA). ANGEA works with governments, society and industry throughout Asia to build effective and integrated energy policies that meet each country’s climate objectives.

-

Civilization1 day ago

Civilization1 day agoThe U.S. and Australia Must Lead the Critical Minerals Race

-

Civilization5 days ago

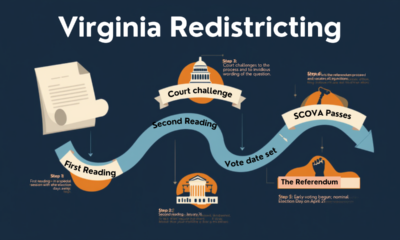

Civilization5 days agoVirginia redistricting – the forgotten theater

-

Education1 day ago

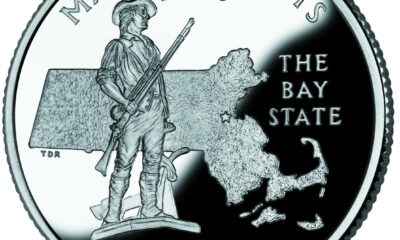

Education1 day agoWaste of the Day: Boston’s Soccer Stadium Cost Almost Tripled

-

Executive12 hours ago

Executive12 hours agoWaste of the Day: Throwback Thursday – Gigantic Internet Routers for One Computer

-

Civilization2 days ago

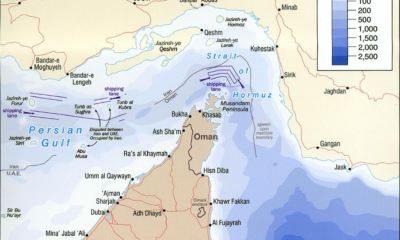

Civilization2 days agoU.S.-Israel Joint Action Against Iran Is Just and Necessary

-

Executive3 days ago

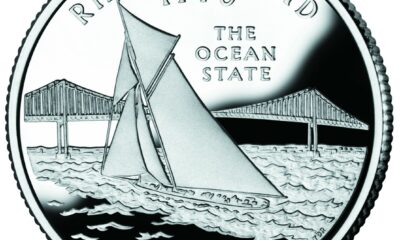

Executive3 days agoWaste of the Day: Rhode Island Overtime Payments Approach $300,000

-

Executive3 days ago

Executive3 days agoWaste of the Day: Prediction: Debt Will Soon Break Record

-

Civilization4 days ago

Civilization4 days agoIran: A Humbling Reminder of the Public Square We Take for Granted