Guest Columns

The LNG Court Ruling That Could Chill Investment in Clean Energy Infrastructure

The DC Circuit Court of Appeals invalidated two LNG export permits that were already issued, imperiling other clean energy projects.

When President Biden signed the Infrastructure Investment and Jobs Act in 2021 and the Inflation Reduction Act the following year, the White House envisioned America actually building things again. A recent court ruling has introduced a chill in the investment marketplace and with it the administration’s ambitious plans to stimulate energy security and reduce emissions.

Revocation of the LNG permits

Last month, a three-judge-panel in a Washington, D.C. circuit court vacated the permits for two liquefied natural gas (LNG) export projects in Texas, sending them back to the Federal Energy Regulatory Commission (FERC) for further review. The court disagreed with how FERC had handled some procedural matters, and as a result, they decided to remand authorization permits that both Rio Grande LNG and Texas LNG received to allow their projects to proceed.

But mind you, this was not a run of the mill procedural challenge. Those happen all the time as permits are being considered. This was a panel of judges quite literally invalidating already-issued permits for projects, one of which enabled construction to begin over a year ago.

If allowed to stand, the precedent from this ruling would be absolutely draconian to investment progress.

Think about the thousands of miles of new interstate transmission lines needed to carry renewable and traditional electrical energy to population centers. Or the carbon capture projects that require pipelines to deliver captured CO2 to injection sites. Or the natural gas lines to new industrial sites for electricity and petrochemicals expansions. The U.S. Department of Energy has announced $7 billion to commercialize hydrogen through a series of hubs, each of which will require massive amounts of all of these infrastructure expansions.

Investment could dry up

All of these are potentially at-risk as a result of this impending new precedent. What fiscally responsible investor would assume such a risk when even lawfully issued permits can be arbitrarily pulled back by the courts? This is not governmental cooperation through agency and legal means. It’s obstructionist.

This threat to clean energy investment isn’t just raw speculation, either. It was central to the court’s decision. For example, the judges said FERC should require more review of a carbon capture and storage (CCS) plan for one of the LNG facilities that was still being planned and not even ready for FERC review. And what is curious is that there is no legal or statutory requirement for CCUS on LNG projects either!

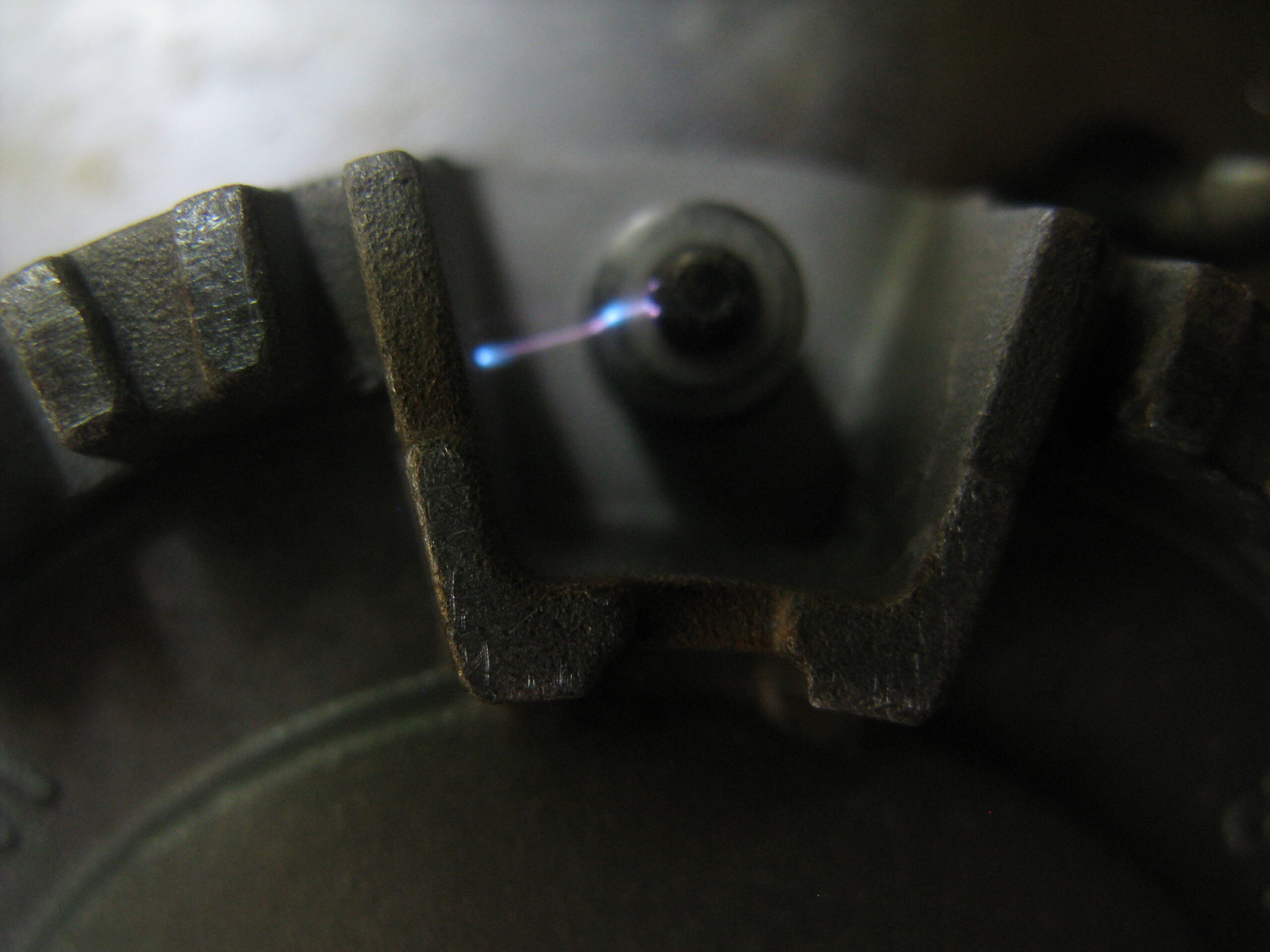

To build a carbon capture project in the United States, a key permit is for a Class VI injection well, which is where the CO2 will be permanently sequestered. Each of these permits take years to secure from the U.S. Environmental Protection Agency (EPA), which currently has a backlog of more than 140 such applications.

Clarity and transparency needed

But now imagine that in addition to waiting on the U.S. EPA, developers must also be concerned about courts pre-empting their plans and delaying the projects where the emissions would be captured, on the circular logic that the carbon capture element was not fully developed yet. How are we going to scale a technology like carbon capture – a core part of the Biden administration’s climate plan – if there aren’t clear rules of the road and confidence in the efficiency of the process?

To be clear, no one is suggesting we make permitting more lenient or that we scrap the rules that keep our air and water clean. And the courts should continue to play an essential role in resolving disputes and interpreting the law. Make the permit process as stringent as required – but make it clear and transparent from the start.

It is not unreasonable to ask that the rules we make industries follow are actually able to be followed. If you do not permit projects by existing rule, you will not get investment. It’s that simple.

It’s no secret that there are plenty of headwinds for investment in major infrastructure projects, clean energy in particular. Inflation has raised the cost of everything. High interest rates make it difficult to secure financing. Continued supply chain constraints from the COVID pandemic are also apparent. And on top of all that – investors are saddled with this inability to advance projects and “do the right thing.”

The LNG precedent shows that the bureaucracy is the problem

For many years we’ve heard people cast blame everywhere on why we aren’t advancing clean energy or building the infrastructure we need. But the biggest impediment is not “Big Oil” or a lack of political will or any of the usual bogeymen. It’s the regulatory uncertainty manufactured by federal agencies and the courts. Interagency collaboration unfortunately becomes an oxymoron – and stands in the way of progress.

This article was originally published by RealClearEnergy and made available via RealClearWire.

Charles McConnell is the former Assistant Secretary of Energy at DOE (2011-13) and currently the Executive Director of the Center for Carbon Management in Energy at the University of Houston.

-

Civilization4 days ago

Civilization4 days agoMaduro’s Capture: U.S. Foreign Policy in Latin America

-

Civilization5 days ago

Civilization5 days agoTrump Lashes Out at Supreme Court as Under ‘Foreign Influence’

-

Civilization5 days ago

Civilization5 days agoTrump Administration Led With the Wrong Agency in Minnesota

-

Guest Columns4 days ago

Guest Columns4 days agoA Bipartisan Fix for the Prescription Drug Market

-

Guest Columns3 days ago

Guest Columns3 days agoWaste of the Day: Thousands of Earmarks in Illinois State Budget

-

Education2 days ago

Education2 days agoIgnoring the Science: The Curious Case of Cell Phone Bans

-

Civilization2 days ago

Civilization2 days agoA Better U.S. Strategy for Greenland Than Annexation

-

Education3 days ago

Education3 days agoA Solid Core Enlivens Free Speech and Viewpoint Diversity