Executive

Waste of the Day: States Are $811 Billion In Debt

State governments across the USA have $811 billion in debt that exceeds their assets, mainly from unfunded pension liabilities.

Topline: America’s 50 state governments will need an extra $811 billion to pay off their current debt, according to the annual “State of the States” report from Truth in Accounting.

States do go into debt – er – taxpayer burden

Key facts: State governments had $2.9 billion in debt and only $2.1 trillion in assets at the end of fiscal year 2023, Truth in Accounting, a nonpartisan organization that promotes fiscal transparency and accountability, found. The gap will need to be covered by taxpayers sometime in the future.

Twenty-seven states have “taxpayer burdens,” meaning their budget is not balanced and they would need to collect at least $900 from every person in the state to eliminate their debt. Massachusetts, Illinois, New Jersey and Connecticut received a letter grade of “F” because they would need over $25,000 from every resident to pay their bills.

Only 23 states had what Truth in Accounting calls a “taxpayer surplus,” meaning they could pay off all of their debt and still have money to return to taxpayers. Four states received a letter grade of “A” because they have a taxpayer surplus above $10,000: North Dakota, Alaska, Wyoming and Utah.

Unfunded pension liabilities contributed $840 billion to the debt. States have promised to eventually pay pensions to teachers, firefighters, cops and more, but have only saved up 70% of the necessary cash.

Other post-retirement benefits are underfunded by $493 billion. They mostly consist of lifetime healthcare plans, for which states have saved up only 14% of the money they’ve promised to current employees.

Yet states have laws requiring balanced budgets

Researchers wrote that

Unfortunately, some elected officials have used portions of the money owed to pension and OPEB funds to keep taxes low and pay for politically popular programs. This is similar to charging earned benefits to a credit card without having the money to pay off the debt.

Underreporting pension liabilities is just one “accounting trick” politicians use to falsely claim their budgets are balanced, according to Truth in Accounting. Some states also overstate their revenue, count borrowed money as income, and more.

Every state has a law requiring their budget to be balanced, except for Vermont.

Search all federal, state and local government salaries and vendor spending with the AI search bot, Benjamin, at OpenTheBooks.com.

Summary: The national debt makes headlines constantly, but the fiscal problems at the state level can’t be ignored.

The #WasteOfTheDay is brought to you by the forensic auditors at OpenTheBooks.com.

This article was originally published by RCI and made available via RealClearWire.

Jeremy Portnoy, former reporting intern at Open the Books, is now a full-fledged investigative journalist at that organization. With the death of founder Adam Andrzejewki, he has taken over the Waste of the Day column.

-

Civilization3 days ago

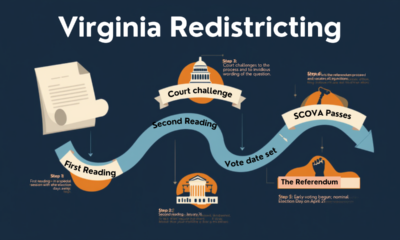

Civilization3 days agoVirginia redistricting – the forgotten theater

-

Civilization4 days ago

Civilization4 days agoWhat the Political Attacks on Fetterman Reveal

-

Civilization5 days ago

Civilization5 days agoTrump’s SOTU Speech a Win, But It’s Not Enough

-

Clergy4 days ago

Clergy4 days agoDecapitating Amalek: Iran, Purim, and the Obligation to Act in Time

-

Education7 hours ago

Education7 hours agoWaste of the Day: Boston’s Soccer Stadium Cost Almost Tripled

-

Civilization3 days ago

Civilization3 days agoIran: A Humbling Reminder of the Public Square We Take for Granted

-

Civilization5 days ago

Civilization5 days agoTop Library Advocate: Backing Drag Queen Story Hour Supports Parental Choice

-

Executive2 days ago

Executive2 days agoWaste of the Day: Rhode Island Overtime Payments Approach $300,000