Money matters

Gold and silver legal tender in Utah

Gold and silver coins are now legal tender in Utah—and worth their weight in gold. This signal is as much financial as political.

The Legal Tender Act of 2011

The Legal Tender Act of 2011 allows any merchant to accept gold or silver coin as payment of any debt. That change by itself wouldn’t mean much. Any United States coin is already legal tender—at its face value. But the new Utah law allows a merchant to credit the one offering the coin for the market value of the metal, not the face value.

This will stop people from melting down coins to sell the metal for more than their face value. But this new law threatens to blow down the world financial system like a house of cards.

What is legal tender?

Legal tender is anything that anyone owing money to another, can offer and know that the other person must accept it. Most civilizations throughout history have accepted gold and silver as legal tender. Even coins from different civilizations were acceptable. Currency exchange was as simple as weighing different coins of the same metal. The only arbitrary rate was the gold-to-silver ratio. Typically this was twenty to one. Thus the first United States silver dollars weighed one ounce. A gold ounce was worth exactly twenty dollars.

The Sixth Amendment to the Constitution recalls this original value of gold. It provided for jury trials in any civil cases in which twenty dollars or more was at stake.

Why has gold and silver increased in value?

[ezadsense midpost]

That’s the wrong question. Gold is the standard of value. But none of the major currencies have any fixed rate of gold exchange. In 1971, the United States stopped exchanging gold for dollars. The United States went into technical default on that day. The only thing that has stopped the dollar from becoming worthless is the petrodollar system.

Until recently, the Federal Reserve System, the central bank of the United States, behaved with enough restraint to stop inflation. Today the Fed is buying Treasury paper—monetizing the debt. It shows no sign that it will stop doing that, and every sign that it will keep doing that.

What can the States do about it?

They’re doing it now. Utah was first State to let people buy things with gold or silver. It won’t be the last. Five other States have considered similar laws. They haven’t passed them yet, but they will.

What will this do to the dollar, and to gold and silver prices?

It will push gold and silver prices higher almost at once. Now, in at least one State, gold and silver are media of exchange, as well as stores of value. When people realize that, they’ll start buying these coins as fast as they can get them. And they will want physical gold and silver, and to have it in their hands.

[amazon_carousel widget_type=”ASINList” width=”500″ height=”250″ title=”” market_place=”US” shuffle_products=”True” show_border=”False” asin=”0446510998, 0470047666, 0385512244, 0470612533, 1449555381, 1586489941, 1451542291, 047047453X, 1460954262, 193317496X” /]

Utah is famous for another reason. The Mormon theology that dominates Utah tells its followers to prepare for any kind of emergency. Mormon “survival outfitters” are famous for selling a year’s supply of food and equipment in a package. Soon people will want the metals to make sure that they can afford the packages.

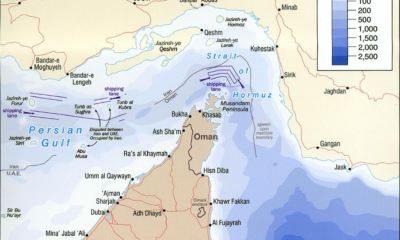

Add this to it: the petrodollar system is breaking down already. China and the OPEC countries are already propping up the euro. Last week, all commodities went up in price.

What next?

Those of you waiting for the prices of gold and silver to stop “correcting” cannot afford to wait any longer. The breakout could come at any time. What Utah did will make it come faster. If other States follow Utah’s lead, the breakout will come shortly afterwards.

The time has come to buy, but not necessarily with the last of your cash, or all at once. Look for dealers willing to make up for a drop in price with extra coins thrown in for good measure. If any dealer offers that kind of trade, buy at least the smallest amount of gold and silver for which that deal will hold. (Some dealers will do that for you if you buy ten thousand dollars’ worth, and will waive their shipping fees if you buy five thousand dollars’ worth.) Silver is highly undervalued—the gold:silver ratio has stayed at about 40. It will likely fall to 16, given silver’s industrial uses. So buy four dollars’ worth of silver for every dollar’s worth of gold. Storage will be that much more difficult, but you can’t help that.

Buy in these increments, once a month, or even once a week, depending on how much cash you have on hand. (The financial advisers call this “dollar cost averaging.”) When the breakout comes, don’t hold back.

[ezadsense leadout]

Terry A. Hurlbut has been a student of politics, philosophy, and science for more than 35 years. He is a graduate of Yale College and has served as a physician-level laboratory administrator in a 250-bed community hospital. He also is a serious student of the Bible, is conversant in its two primary original languages, and has followed the creation-science movement closely since 1993.

-

Civilization3 days ago

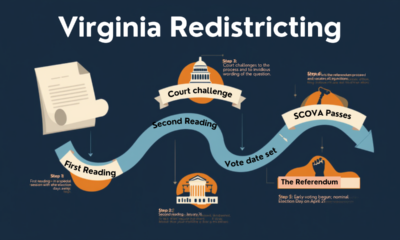

Civilization3 days agoVirginia redistricting – the forgotten theater

-

Education5 days ago

Education5 days agoWaste of the Day: DEI Contractors Remain in Military’s K-12 Schools

-

Civilization3 days ago

Civilization3 days agoWhat the Political Attacks on Fetterman Reveal

-

Civilization5 days ago

Civilization5 days agoAt a Time of International Turmoil, ARC-ES Can Bring Energy Stability to the U.S.

-

Civilization4 days ago

Civilization4 days agoTrump’s SOTU Speech a Win, But It’s Not Enough

-

Clergy3 days ago

Clergy3 days agoDecapitating Amalek: Iran, Purim, and the Obligation to Act in Time

-

Civilization4 days ago

Civilization4 days agoTop Library Advocate: Backing Drag Queen Story Hour Supports Parental Choice

-

Executive1 day ago

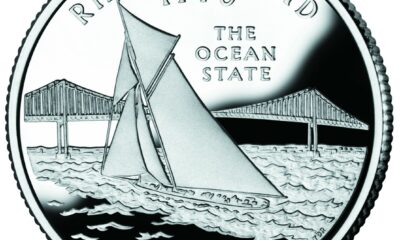

Executive1 day agoWaste of the Day: Rhode Island Overtime Payments Approach $300,000

Historically and even currently, gold has not kept up with inflation. The current “gold bubble” is a market correction of historically low gold prices (vs inflation) throughout the late 80s and 90s, where gold value was highly recessed. Gold is as much of a fiat currency as any currency that is not based in gold.

If you want to REALLY prepare for the end of days, start taking all your money and putting it into gasoline, water, and MREs, and you’ll be a lord of the post apocalyptic wasteland that is sure to follow.

How can gold be a fiat currency? It’s a solid metal, something you can hold in your hand. Its quantities, if they are not fixed now, will be fixed soon as the mines give out. It will surely double–as silver increases five-fold.

I am assuming that if you own gold and had an interest in its price increase, you would make that known somewhere on this column that if people followed your “Buy gold, buy it now and buy it a lot” advice that you might profit from it…?

My interest is in a store of value. What you just said is typical of the trouble in this world: when people treat basic things like a store of value, or a place to live, as investments to be bought into or cashed out of.

And may I assume that you have an interest in keeping people dependent on a fiat money unit that is not worth the paper it’s printed on?

The simplest thing that the government can do, to make an end of speculation on the price of gold or silver, is to make it legal tender for all debts, public and private, and to pledge to redeem dollars for gold. Then the price of gold would be fixed. But then that old quantitative easing thing would be impossible. Can’t have that.

Time was when a dollar bore the message “The United States of America will pay to the bearer on demand one dollar.” What happened to “will pay to the bearer on demand”? Oh, yeah…we don’t have it, do we? But we’ve got so much land locked up in the West and in half the state of Alaska. You know something? Governor Palin ought to have raised the National Guard and declared secession from the Union. The Governor of Utah has done the next best thing.

Your argument might have some justice, if you were advising people to buy silver exclusively. (You will note that I advised buying 4 parts silver to 1 part gold.) But you don’t. Why not?

gold is a fiat currency because it’s intrinsic value is low (or not ever even realized). Gold is simply valuable because we say that is valuable and everyone more or less agrees upon that fact. You can’t eat gold, you can’t drink gold, the only reasonable use of gold is as a conductor of electricity (which is rarely done because gold is “too valuable” for such things).

FURTHER, if we ever DID realize a gold ceiling (meaning that all the gold of the finite supply has now been mined out of the earth), then we’d simply have deflation if we attempted to stick to a gold standard (which is generally worse than inflation). So gold is valuable essentially, because it is shiny, and people like shiny things. If we are talking some end of the world scenario, then there is no need for gold anyway, as who wants a shiny metal when food and water are absolutely the most important commodities?

Long story short, gold prices will continue to climb so long as the economies of the world are generally in recession. When that stops happening, people will be happy to put their money back into stocks, index funds, and other (generally more reliable) forms of investment. Groupon is filing for an IPO and people are thinking that the price my hit over 100 dollars per share on the first day. Obviously that’s not a reasonable price to ask for a company that can’t make money, but it shows how many investors are eagerly looking to put their money back into the economy, so long as they can find something they think will be a winner.

Phil has the right of it. You cannot eat gold or silver. If you have the gold, but I have the food, I could just let you starve, and then take your gold anyways. Sustainable sources of food, water and electricity are a much, much wiser investment, especially in an apocalyptic scenario. Don’t buy gold, buy solar panels. Don’t hoard silver, horde food. A well in a desert is worth a thousand mines.

What is a sustainable source of electricity? The sun might shine bright enough to keep your house cool in summertime. Maybe. Depends on where you live. But what works in Arizona will not work in Minnesota. And besides, we deal here with a store of value. Gold will always be the universal desirable. Especially when, as is inevitable, the gold mines give out.

Solar, wind, we can collect energy from the waves in the ocean, the current in the rivers, we can collect energy through geothermal vents, and we can even engineer biomass to burn sustainably (although this isn’t a clean energy source, just a sustainable one). All of these things we can do. Very few places are truly without any source of sustainable energy. Metals are better used to produce something worthwhile and productive than sitting in a vault waiting for the world’s mines to all peter out. Electricity can be used, and even sold back into the grid if you have too much of it. A personally owned source of sustainable energy will generate far greater profit than gold or silver ever will.

and one more thing, MREs, potable water, purifiers, and all the other things you need to live in a post apocalyptic world where society has collapsed are relatively cheap, and their value will skyrocket after such a catastrophe, so wouldn’t they be a better investment than gold, presuming you want to use gold or other precious metals as a holder of value in such a world?

What is the endgame of having a highly illiquid asset sitting in your basement if the world is going to chaos anyhow?

Here’s the thing, though. Terry has a good point. Since the dawn of human civilization (whether you’re a young-Earth bible thumper or a Darwinian bible thumper), gold and silver have had value.

To some (as ancient Egypt), gold was viewed as largely worthless (but they DID value glass). However, for the most part by and large, gold has been the standard of trade, when items couldn’t be bartered for (i.e. eggs for bread).

Considering most of human existence has been on a par with the “post-apocalyptic wasteland” referenced here, and that gold was used as a standard, establishes Terry’s point and credibility without argument.

But *ANYTHING* can be a fiat currency, INCLUDING food and water. You want proof? The average American wastes more water a year than most villages in Africa get! So any argument about *anything* being a fiat currency is a dull argument at best.

*Anything* only has value because we say it does. Even in a post-apocalyptic wasteland.

Both sides make valid points.

However, there is also merit in having food, water, and other essentials in supply as well, just as human civilization always has.

The State of Utah, and other States of the Union, that wish to pass laws; under the Constitution, declaring gold and silver coin as a legal tender; their legislators would probably want want to read the following, “The United States government does not have the power to make its obligations a legal tender” (online). Its author, Dan Goodman shows that McCulloch v. Maryland was wrongly decided, that the concept of implied powers does not exist in the Constitution. That the Tenth Amendment applies.