Money matters

Gold and silver at temporary peak

The prices of gold and silver are peaking now. They may fall, but not very far—and the next buying opportunity will not last long.

Where gold and silver now stand

Gold has set three records in a row. But today it closed up by not much more than a dollar and a half. During the day it traded as high as $1594 an ounce, and then fell as low as $1581. Obviously, traders have set their next limit at $1600. The gold price did not go over that limit, and is not likely to.

Silver went as high as $39.33, and then lost nearly everything it had gained today.

The long-term trends for gold show a steady rise. Gold is not likely to lose that momentum—unless government and Federal Reserve policies change radically, and permanently.

Silver raced to an early record, then fell back, and has been level for the last eight to ten weeks. But silver has more than tripled in price in the last five years.

What’s happening to gold and silver?

Gold is the traditional large-scale, standard-setting store of value. In the last few weeks, holders of euros have dumped them for gold on a very large scale. The reason: the day of judgment in Greece (or to use the Greek word for it, the crisis) is not finished yet, and is getting worse. And: Greece is not the only country in Europe to face a day of judgment. Italy faces its own day of judgment. And before putting US debt under review, Moody’s Investors Service downgraded Ireland’s debt.

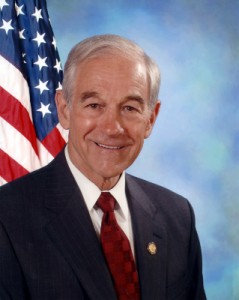

Yesterday, Representative Ron Paul (R-TX-14) questioned Federal Reserve Chairman Ben Bernanke on his handling of the money supply. In that interview, Bernanke said something incredible:

Q. Do you think gold is money?

A. No. Gold is not money.

Later, Paul asked Bernanke why the Federal Reserve, and indeed all central banks, hold gold. Bernanke’s answer: “tradition,” begging the question.

Your editor will try to answer. Gold, uniquely among metals, does not perish and is not subject to corrosion. Only one substance known to man can attack gold chemically: the mixture of hydrochloric and nitric acids called aqua regia (king’s water). Because gold is so difficult to react, it is easy to refine.

Silver is another matter. Silver rises and falls with stocks, and with the larger economy, much more than gold. Silver has direct industrial uses, and those uses have a strong influence on its value.

Before the Industrial Revolution, gold was about twenty times more valuable than silver. Thus the original one-dollar coin was of silver. A gold ounce was worth twenty dollars. (This is the basis of the Sixth Amendment to the Constitution, that says that a defendant in a lawsuit worth twenty dollars or more deserves a jury trial.)

Today the gold-silver ratio is twice that. Numbers like these suggest a market that wants a large-scale store of value and has little need to use a metal in industry.

What happens now?

Gold is likely to fall again. Like some stocks, gold might form the second part of a “double bottom.” After that, gold will rally. The reasons for this are not merely technical. The world’s economy is still on a shaky foundation. More than that, America will soon face its own “day of judgment.”

Gold will likely start its rally in late August or early September. Then it will double before it pauses. But it will dip before then, so watch for an opportunity to buy it cheap. (Or else, make sure to buy it from a dealer who offers a price guarantee.)

Silver is level now. It will rally at or about the same time as gold does. Its price will likely increase fourfold or even fivefold.

Recommendations

For gold: Hold.

For silver: Buy.

Featured image: gold coins recovered from a pirates’ cache.

ARVE error: need id and provider

Terry A. Hurlbut has been a student of politics, philosophy, and science for more than 35 years. He is a graduate of Yale College and has served as a physician-level laboratory administrator in a 250-bed community hospital. He also is a serious student of the Bible, is conversant in its two primary original languages, and has followed the creation-science movement closely since 1993.

-

Civilization5 days ago

Civilization5 days agoWhy Europe Shouldn’t Be Upset at Trump’s Venezuelan Actions

-

Christianity Today5 days ago

Christianity Today5 days agoSurprising Revival: Gen Z Men & Highly Educated Lead Return to Religion

-

Civilization2 days ago

Civilization2 days agoTariffs, the Supreme Court, and the Andrew Jackson Gambit

-

Civilization3 days ago

Civilization3 days agoWhy Europe’s Institutional Status Quo is Now a Security Risk

-

Civilization4 days ago

Civilization4 days agoDeporting Censorship: US Targets UK Government Ally Over Free Speech

-

Executive3 days ago

Executive3 days agoWaste of the Day: Wire Fraud, Conflicts of Interest in Connecticut

-

Civilization3 days ago

Civilization3 days agoEpstein and the destruction of trust

-

Civilization2 days ago

Civilization2 days agoTrump Lashes Out at Supreme Court as Under ‘Foreign Influence’

Gold and silver have only a very limited industrial value.

A gold standard would be no better than fiat currency, since gold itself is about as worthless as paper money.

Currency is just a means to control. Lazy men and women get to rule the world just because their bank accounts are well padded. The people are held hostage by those with currency, because they are under the illusion that money is necessary. It’s just an illusion.

All the owners and businessmen and bankers and stockbrokers could disappear tomorrow and the world would keep running. They don’t work the factories and the fields, they don’t make anything. They are unnecessary.

That would be an interesting debate. Finally you make yourself abundantly clear: that it’s all a matter of seizing the machinery. Well, tell me this: who’s going to build the machinery for you to seize? Blank-out.

What would happen if all the inventors and real business leaders of the world went on strike? I’ll let you guess the consequences.