Money matters

Gold breaks $1600 intra-day

Gold broke the $1600 barrier in intra-day trading this morning—twice. The debt ceiling drama is only one reason among many.

What happened to gold and silver

On Friday, gold closed at $1589.80, up only eighty cents an ounce at the New York Commodity Exchange. Then this morning it broke another ceiling at $1600. At first it fell back abruptly, at 8:00 this morning (Eastern time). Then, at about 10:30, it broke above $1600 again and is still rising at this hour (11:07 a.m.).

Silver is rising, too, now up $1.54 per ounce and well above $40 per ounce.

What’s driving these metals higher

Gold and silver are rising for at least two reasons. The immediate reason is the debt ceiling talks. They are going nowhere. Investors know it. They are looking for a store of value. This had to happen sooner or later.

The long-term reason is that central banks, as a group, are buying gold, and buying it faster than ever. Standard Chartered Plc guesses that gold will reach $2000 an ounce by 2014, and $5000 an ounce by 2020. The Chinese central bank (and, incredibly enough, ordinary Chinese men-on-the-street) will buy gold faster than Chinese gold miners can dig it out of the ground. That might be happening already. Other central banks will likely do the same.

Prices for all physical, hold-in-your-hand things are going up. Countries are debasing their currencies everywhere. So everyone is looking for a solid store of value.

Is this the big rally?

That’s hard to tell. If the US government does something sensible about its massive debt, gold might fall back once more. Gold will still rise by year’s end. Too many people want it, and will still want it, for gold not to rise in price.

But the government might not do the sensible thing. Worse, Standard and Poor’s might downgrade US Treasury paper, debt ceiling rise or no, if the government cannot cut its debt enough. (“Enough” is $4 trillion over ten years.) If that happens, gold will rally now, not later.

Recommendations

Gold: Buy

Silver: Buy

Featured image: gold coins from a pirate’s treasure.

ARVE error: need id and provider

[amazon_carousel widget_type=”ASINList” width=”500″ height=”250″ title=”” market_place=”US” shuffle_products=”True” show_border=”False” asin=”0446510998, 0470047666, 0385512244, 0470612533, 1449555381, 1586489941, 1451542291, 047047453X, 1460954262, 193317496X” /]

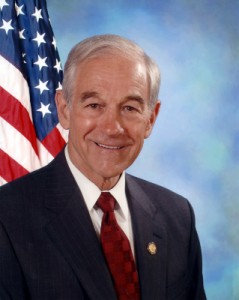

Terry A. Hurlbut has been a student of politics, philosophy, and science for more than 35 years. He is a graduate of Yale College and has served as a physician-level laboratory administrator in a 250-bed community hospital. He also is a serious student of the Bible, is conversant in its two primary original languages, and has followed the creation-science movement closely since 1993.

-

Civilization5 days ago

Civilization5 days agoWhy Europe Shouldn’t Be Upset at Trump’s Venezuelan Actions

-

Christianity Today5 days ago

Christianity Today5 days agoSurprising Revival: Gen Z Men & Highly Educated Lead Return to Religion

-

Civilization2 days ago

Civilization2 days agoTariffs, the Supreme Court, and the Andrew Jackson Gambit

-

Civilization3 days ago

Civilization3 days agoWhy Europe’s Institutional Status Quo is Now a Security Risk

-

Civilization4 days ago

Civilization4 days agoDeporting Censorship: US Targets UK Government Ally Over Free Speech

-

Executive3 days ago

Executive3 days agoWaste of the Day: Wire Fraud, Conflicts of Interest in Connecticut

-

Civilization3 days ago

Civilization3 days agoEpstein and the destruction of trust

-

Civilization2 days ago

Civilization2 days agoTrump Lashes Out at Supreme Court as Under ‘Foreign Influence’

[…] Gold breaks $1600 intra-day […]