Money matters

Quantitative Easing: Theft!

Ben Bernanke, head of the Federal Reserve, announced another round of “quantitative easing” yesterday. The Fed will buy $40 billion worth of mortgage-backed bonds every month, until further notice. When he said that, stocks and commodities (including oil and precious metals) both rose in price. Bonds, especially the longer-term bonds, went down, and their yields went up. This “quantitative easing” program will not and cannot add more wealth to the economy. Instead it will steal a lot of wealth, mainly from the poor and especially the middle class, for the temporary benefit of stock investors.

Quantitative easing: what’s it all about?

In “quantitative easing,” a central bank buys a lot of its government’s debt to put cash into people’s hands. Jill Schlesinger at CBS News tried to explain it this way. The central bank buys a lot of the government’s bonds. With fewer government bonds available, bond investors look for other bonds to buy. So they buy corporate bonds. When they do that, they lend their money to the companies that issue them. Presumably those companies can spend the money to hire, expand, and do more business. (But investors can also buy foreign bonds, as any regular bond investor could tell them.)

In an interesting “twist” (the literal name), the Fed will sell short-term bonds to raise money to buy longer-term bonds. That might explain why bond yields, at all terms, are going up.

The Fed also expects “quantitative easing” to add money to the banking system. Schlesinger didn’t say how. But the usual result from such “open market operations” is adding to the money that banks can borrow from the Fed.

The Fed has already spent nearly two trillion dollars buying these bonds since 2009. Or more likely, it has arbitrarily “certified” that it has the money to do these things. Remember: the United States Dollar is a fiat currency. Fiat is a literal Latin word meaning “Let it exist!” So the Fed said, “Let there be money!” And there was money. (Genesis 1:3, paraphrase.)

To certify anything is to bear witness to it. But the markets already say that the Fed is bearing false witness.

Hard values go up

Gold, silver, and oil are all commodities. As such they are a hard store of value. Many things can affect their price. But the value of a dollar affects it most of all.

Yesterday the price of oil rose to more than $100 a barrel. The Associated Press quoted an oil-market analyst who told the truth:

[The Fed will start] flooding the market with dollars[!]

When you make a thing more abundant, everything else is more scarce. The more-scarce goods cost more. That is an elementary fact. Everyone knows it. Except, it seems, central bankers.

Gold and silver market analysts have said for years that gold will someday double in price, and silver multiply its price by four or five. Yesterday gold closed up nearly $40 an ounce. Its price at time of writing is $1773.51 an ounce. (Silver sells for $34.50 an ounce.)

How does this affect you?

A Weimar-era householder wheels a barrow full of worthless Reichsbanknotes to the corner baker to buy a loaf of bread. Will the US economy reduce people to this, when it runs out of other people’s money?

The price of oil will affect the middle class far more than gold or silver. Gold has few industrial uses; silver has a few more. But oil affects the price of every single other thing in the economy. It affects the price we pay to make things, and to move them.

So what does “quantitative easing” really do? The Fed says, “Let there be money.” And there is money. Stock investors get most of it, because they know that people will buy the bonds of the companies that issue the stock. But the typical middle-class householder suddenly must pay more for the motor fuel to get to the hardware store or grocery store. And pay more for the goods he or she buys at those stores. (After all, the trucker who brings the goods to the store must buy motor fuel, too.) Result: that householder pays more. Why? The money he or she holds is worth less. The Fed makes it worth less, to have money to buy government bonds and pour money into the fractional-reserve bank system.

In sum: “quantitative easing” is a way to steal money from the poor and middle class, and give it to investors. The most charitable way to say it is: an arm of the government takes private property for public use, without just compensation. Thus “quantitative easing” is a vicious twist on “eminent domain.” And the way the Fed does it, breaks the Fifth Amendment to the Constitution.

This effect is happening now. Years later, inflation will happen. It happened before, in the last century. Not all the Ninety-day Wage and Price Freezes, Pay Boards, Price Commissions, and Whip Inflation Now buttons that Presidents Nixon and Ford could invent, could stop it. Nor did Jimmy Carter stop it. Ronald Reagan and his Fed chairman, Paul Volcker, stopped it, but it hurt. Badly. This time it might do more than hurt. It could kill the economy.

Investors Business Daily said yesterday evening that “quantitative easing” did not work before, and will not work now. They warned the government to stop the spending. But other observers wonder whether it’s too late even for that.

What can you do about it?

[ezadsense midpost]

If you can afford to buy gold or silver, do it. Now. Before the price goes out of sight. (Only don’t tell anybody! One family made that mistake, and this happened to them. Yes. Right here in the USA.)

Also: get out of the city. Hyperinflation will do worse than have people wheeling barrows full of money to the corner baker to buy a loaf of bread. The baker might not have it to sell at any price!

A loaf of bread for a day’s wages, and three beers for a day’s wages, and please don’t damage the oil or the wine! [Revelation 6:6, paraphrase]

Some advisers suggest you go past buying gold and silver, and buy the other precious metal: lead. And cold, sharp steel. And the things that a twelve-year-old John F. Kennedy said he had to buy (with the spelling cleaned up):

canteens, haversacks, blankets, searchlights, ponchos,

and tents, flint-and-steel, and fishing tackle.

That’s what people will have to do, if policies like “quantitative easing” do not stop. But everyone should recognize now that “quantitative easing” is theft. The Constitution at least defines a useful purpose of taxes. It defines no such purpose for debasing the currency, and worse: having a currency designed for such debasing.

[amazon_carousel widget_type=”ASINList” width=”500″ height=”250″ title=”” market_place=”US” shuffle_products=”True” show_border=”False” asin=”0446510998, 0470047666, 0385512244, 0470612533, 1449555381, 1586489941, 1451542291, 047047453X, 1460954262, 193317496X” /]

[ezadsense leadout]

Terry A. Hurlbut has been a student of politics, philosophy, and science for more than 35 years. He is a graduate of Yale College and has served as a physician-level laboratory administrator in a 250-bed community hospital. He also is a serious student of the Bible, is conversant in its two primary original languages, and has followed the creation-science movement closely since 1993.

-

Civilization4 days ago

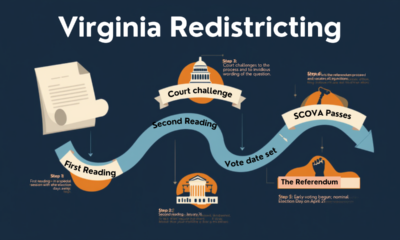

Civilization4 days agoVirginia redistricting – the forgotten theater

-

Civilization4 days ago

Civilization4 days agoWhat the Political Attacks on Fetterman Reveal

-

Civilization4 hours ago

Civilization4 hours agoThe U.S. and Australia Must Lead the Critical Minerals Race

-

Clergy4 days ago

Clergy4 days agoDecapitating Amalek: Iran, Purim, and the Obligation to Act in Time

-

Education16 hours ago

Education16 hours agoWaste of the Day: Boston’s Soccer Stadium Cost Almost Tripled

-

Civilization3 days ago

Civilization3 days agoIran: A Humbling Reminder of the Public Square We Take for Granted

-

Executive3 days ago

Executive3 days agoWaste of the Day: Rhode Island Overtime Payments Approach $300,000

-

Civilization1 day ago

Civilization1 day agoU.S.-Israel Joint Action Against Iran Is Just and Necessary

[…] them! And when you create more of a thing, you make the other copies worth less. By doing that, you steal from those prudent enough to save, if they had the bad sense to save their money in US […]

[…] See also here. […]

[…] be available via the destructive policies of “Monetizing Debt”, better known as “Quantitative Easing” but should be called what it really is, “Currency Devaluation“. Read the […]