Constitution

IRS targets conservative groups

Members and leaders of conservative groups (and libertarian groups, too) have long suspected it. Yesterday the Internal Revenue Service (IRS) admitted it. The IRS actually apologized for making things difficult for conservative groups who apply for tax-exempt status. As usual in cases like these, they laid the blame with middle managers in one office. But they offer no reason to doubt that the IRS routinely targets conservative groups or libertarian groups for special grief.

What the IRS did

Section 501(c) of the Internal Revenue Code governs non-profit charities, political education groups, and other such groups. The IRS has a specific division to screen applicants for tax-exempt status under that section. That division also makes sure any group getting the status behaves itself as it promised when it applied.

Lois Lerner runs that division. Yesterday she spoke before a conference of tax lawyers, a conference that the American Bar Association arranged. She took a question about a raft of complaints from several conservative groups about how her division was treating them. The Associated Press first reported on this at 12:25 p.m. According to them, Ms. Lerner admitted that any organization having the phrase “Tea Party” or the word “Patriot” in its name, could expect to have to submit extra information when they applied for a tax exemption. Sometimes the IRS office would ask those groups to list their donors.

The IRS never admits to wanting to know who gives regularly to any group. So when Ms. Lerner said that, she had to say that this breaks IRS policy “in most cases.”

That was wrong. That was absolutely incorrect, it was insensitive and it was inappropriate. That’s not how we go about selecting cases for further review. The IRS would like to apologize for that.

If we are to believe Ms. Lerner, all the shenanigans occurred at the IRS center in Cincinnati, Ohio. The Cincinnati office is the main office for handling applications like this. So Ms. Lerner laid all the blame on low-level staff in that office. She said they had a flood of applications to deal with, and came up with this scheme to manage the flow.

Except that they weren’t trying to manage any flow. They wanted those groups to withdraw their applications. Which 25 of them did. All this happened, by no coincidence, last year – the year of a Presidential election campaign.

The AP offered this more detailed report at 6:14 p.m. Zach Goldfarb and Karen Tumulty at The Washington Post weighed in the same day. Goldfarb and Tumulty offered further details. Of 300 groups that the Cincinnati office flagged for further review, 75 had the phrase “Tea Party” or the word “Patriot” in their names. Goldfarb and Tumulty suggested that Ms. Lerner simply spoke out-of-school to those tax lawyers, and the IRS was not ready to handle the flood of calls – and catcalls – that followed.

White House Press Secretary Jay Carney certainly wasn’t ready for it. When the Press Corps asked him about it, he said the IRS was “an independent enforcement agency.” Funny – it always lists itself as part of the Department of the Treasury. That applies to its mailing address and its Internet domain.

Aside: Some anti-tax activists have suggested the IRS is really a private corporation with a charter from Puerto Rico. No doubt those same activists will seize on Mr. Carney’s remarks as further evidence to support their claims. They’re trying to show that, as a “private corporation,” the IRS has no authority to do what it does.

What the problem is

The conservative groups who faced the extra IRS review, all applied for tax exemption under Section 501(c)(4) of the tax code. Such an organization mainly does social-welfare work but may endorse political candidates and comment on political issues. A 501(c)(4) group is tax exempt, but one who gives to it may not deduct the gift from his own taxes. (But such a donor need not give out his name.)

But who decides whether any given group is primarily social, or all political? Right: the IRS.

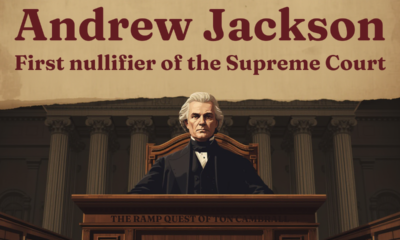

This, of course, brings back memories. One of the key Articles of Impeachment against President Richard M. Nixon accused him of misusing the IRS in just this way.

Last year, The New York Times said, not that the IRS wasn’t targeting anyone, but that it darned well should.

Taxpayers should be encouraged by complaints from Tea Party chapters applying for nonprofit tax status at being asked by the Internal Revenue Service to prove they are “social welfare” organizations and not the political activists they so obviously are.

No, Mr. Sulzberger. Taxpayers can take little comfort when the IRS persecutes a conservative group, or a libertarian group, who acts in the taxpayers’ ultimate interest: to reduce the burden of government, and the high taxes that support it. (Or try to.) The Wall Street Journal understands this.

Several Tea Party spokespeople said they would not accept any apology from the IRS. Senators Orrin Hatch (R-UT) and Mitch McConnell (R-KY) have said much the same. But Mr. McConnell then called on the White House to investigate the IRS. Excuse me? That’s like asking the alpha fox to investigate the beta fox for raiding the henhouse. CNAV has heard of “exhaustion of remedies,” but this seems a stretch, at best.

In point of fact, as long as the IRS can decide, with no one to gainsay it, what group is mainly a “social welfare” group and what group is not, no one is safe. At best, the IRS would “go where the money is” and seek any excuse to deny a tax exemption. At worst, the IRS might decide – as evidently someone in the Cincinnati office decided, if not Lois Lerner herself – that “social welfare” and “conservative group” are oxymoronic, hence ipso facto incompatible. And so, no conservative group would get a tax exemption. And no church, either, except for a liberal church – for though most churches won’t endorse political candidates, the IRS might decide to persecute any church that did not conform to Marxist “economic liberation theology.”

And more to the point: the IRS has the task, under the Obamacare law, to enforce that law. Will they next deny tax exemptions to any conservative group or libertarian group that dares oppose it?

[subscribe2]

Terry A. Hurlbut has been a student of politics, philosophy, and science for more than 35 years. He is a graduate of Yale College and has served as a physician-level laboratory administrator in a 250-bed community hospital. He also is a serious student of the Bible, is conversant in its two primary original languages, and has followed the creation-science movement closely since 1993.

-

Civilization3 days ago

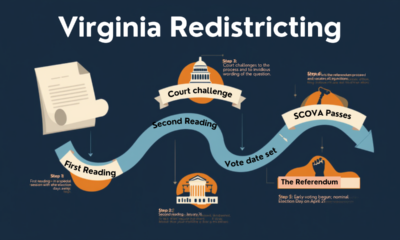

Civilization3 days agoVirginia redistricting – the forgotten theater

-

Civilization4 days ago

Civilization4 days agoWhat the Political Attacks on Fetterman Reveal

-

Civilization5 days ago

Civilization5 days agoTrump’s SOTU Speech a Win, But It’s Not Enough

-

Clergy4 days ago

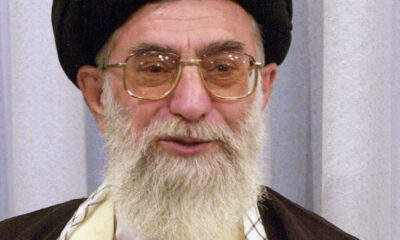

Clergy4 days agoDecapitating Amalek: Iran, Purim, and the Obligation to Act in Time

-

Executive2 days ago

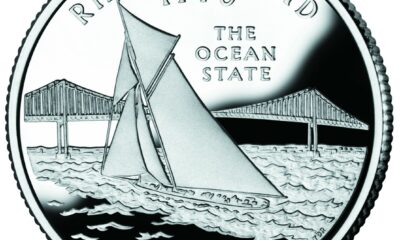

Executive2 days agoWaste of the Day: Rhode Island Overtime Payments Approach $300,000

-

Civilization5 days ago

Civilization5 days agoTop Library Advocate: Backing Drag Queen Story Hour Supports Parental Choice

-

Civilization3 days ago

Civilization3 days agoIran: A Humbling Reminder of the Public Square We Take for Granted

-

Executive1 day ago

Executive1 day agoWaste of the Day: Prediction: Debt Will Soon Break Record

Michael Alan Kline Sr liked this on Facebook.

[…] IRS targets conservative groups […]

[…] IRS targets conservative groups […]

[…] plot surrounding the Internal Revenue Service (IRS) and its targeting of conservative groups, thickened this weekend. An Inspector General’s report confirmed what many […]

[…] admitted only that organizations having “Tea Party” or “Patriot” in their names, faced stricter […]

[…] American people found out last week that the IRS has targeted “Tea Party” and “Patriot” groups. Lois Lerner, the […]