Money matters

End the Federal Reserve

I have said that if I were elected, two of the first things on my agenda would be getting the United States out of the United Nations and ending the Federal Reserve. Why do I believe so strongly that the United States should end the Federal Reserve’s control of the monetary system?

The Federal Reserve creates money from debt

First a little background. Currently any money that is created comes into existence as debt. The United States government goes into more debt when it gets dollars from the Federal Reserve or individual Americans go into more debt when they take out loans from individual banks.

If the U.S. decides it needs more dollars it can’t just start up the printing press and print them. It has to ask the Federal Reserve for the dollars. The Federal Reserve as you hopefully know, is a privately owned central bank that has been granted authority by the U.S. congress to issue dollars, set interest rates, and “run the United States economy.” All U.S. government debt is created through the Federal Reserve System.

When the government wants more money, it must swap U.S. Treasury Bonds for Federal Reserve Notes thus creating more government debt. The term “printed money” is a misnomer because it is normally just digitally credited on the Federal Reserve’s computers. The Federal Reserve notes, or “dollars,” are created digitally, are backed by nothing, and have no intrinsic value.

Monetizing the debt

The Federal Reserve then takes the U.S. Treasury Bonds it received in exchange for the Federal Reserve notes and sells them to investors, such as other nations, like China. Sometimes they sell them back to themselves, which they have been doing a lot of lately. That is known as monetizing the debt, or creating the money to buy your own debt, but the interest to pay the debt is not created which usually requires borrowing even more money. This all creates an endless cycle of debt and shrinking values for the dollar. The dollar has lost 98% of its value since the Federal Reserve was created in 1913.

None of this is a mistake; it’s the way the system was designed. It was designed to enslave the U.S. government, and all of us, in perpetual debt. The U.S. government could start the process of getting out of debt by abolishing the Federal Reserve, taking control from the private bankers, and issuing debt free money. Instead the Federal Reserve seems to grow more powerful by the day.

You and I cannot make money magically appear and neither can the U.S. government. Only the Federal Reserve has the legal right to do that. One of the ways they do that is through the magic of fractional reserve banking.

Fractional reserve banking

The New York Federal Reserve Bank explains fractional reserve banking to us like this: “If the reserve requirement is 10%, for example, a bank that receives a $100 deposit may lend out $90 of that deposit. If the borrower then writes a check to someone who then deposits the $90 check, the bank receiving that deposit can lend out $81. As this process continues, the banking system can expand the initial deposit of $100 into a maximum of $1,000 of created money (100+90+81+72.90+, etc=1,000).

Sounds pretty complicated, but it’s simpler that it seems. The bank doesn’t keep all your money on deposit in case you want it back. It loans most of it out and keeps only a tiny “reserve amount.” Any bank can loan out as much as it wants, i.e. create its own money, as long as it keeps enough to satisfy the Federal Reserve’s legal requirements. If we all went to the bank at the same time, only a tiny bit of our money would be there.

Recently Dr. Ron Paul gave a speech to the CATO Institute in which he said “I think there’s no doubt that the Federal Reserve is immoral. It’s unconstitutional and it’s a disaster. We don’t need it.” I would add that its policies have ruined savers, destroyed the middle class, and created a debt tidal wave that should terrify everyone who understands it.

Who stands in our way?

Why then can’t we just return to sound money and be done with the Federal Reserve? Because interest groups benefit from things remaining the way they are. The big banks, the big bond dealers, the Federal Government which is now a debt slave and many others benefit from the power to create money and the willingness to do it.

Our economic structures, and our very lives, have become dependent on the whims of a group of unelected monetary dictators. The most dependent is the government itself which must have the Fed’s power to print in the event of crises. No need for sanity with the Fed there, and therefore, it is not much of a stretch to say that it has usurped the Congress and the President and actually controls the country.

Think about the real effect of what all this means. Without the Fed, there would have been no invasion of Iraq absent impossible to pass tax hikes. Without that invasion there would be no ISIS and without ISIS no invasion by immigration of Europe and the United States. No invasion of Afghanistan, no attack on Libya and no regime change by force in Syria. Speculation you say? Perhaps, but if so it as a very reasonable speculation.

What to do?

What should be done; that is the question? Keep in mind that I am the only Presidential candidate who will even touch this issue. End the Fed right now; that’s my position. Return to sound non-debt money with a gold backed dollar. Allow competing currencies so people could use whatever currency they choose. Let the free market set interest rates. Soon this would be a dynamic, growing economy again. At least that’s the way I see it.

Darrell Castle is an attorney in Memphis, Tennessee, a former USMC Combat Officer, 2008 Vice Presidential nominee, and 2016 Presidential nominee. Darrell gives his unique analysis of current national and international events from a historical and constitutional perspective. You can subscribe to Darrell's weekly podcast at castlereport.us

-

Civilization3 days ago

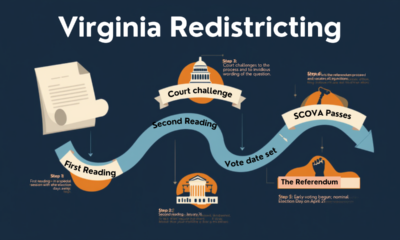

Civilization3 days agoVirginia redistricting – the forgotten theater

-

Education5 days ago

Education5 days agoWaste of the Day: DEI Contractors Remain in Military’s K-12 Schools

-

Civilization3 days ago

Civilization3 days agoWhat the Political Attacks on Fetterman Reveal

-

Civilization4 days ago

Civilization4 days agoTrump’s SOTU Speech a Win, But It’s Not Enough

-

Civilization5 days ago

Civilization5 days agoAt a Time of International Turmoil, ARC-ES Can Bring Energy Stability to the U.S.

-

Clergy3 days ago

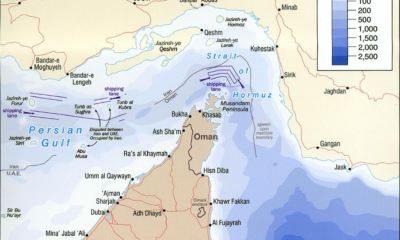

Clergy3 days agoDecapitating Amalek: Iran, Purim, and the Obligation to Act in Time

-

Civilization4 days ago

Civilization4 days agoTop Library Advocate: Backing Drag Queen Story Hour Supports Parental Choice

-

Executive2 days ago

Executive2 days agoWaste of the Day: Rhode Island Overtime Payments Approach $300,000

Johnny Helbo liked this on Facebook.

Ron Chronicle liked this on Facebook.

RT @Terry A. Hurlbut: End the Federal Reserve #endthefed #money #debt #tcot link to t.co

Quintin VK liked this on Facebook.

Robert Williams liked this on Facebook.

Wanda Stewart liked this on Facebook.

Edward Krol liked this on Facebook.

Charlotte Laborde liked this on Facebook.