Money matters

Wealth tax to wealth destruction

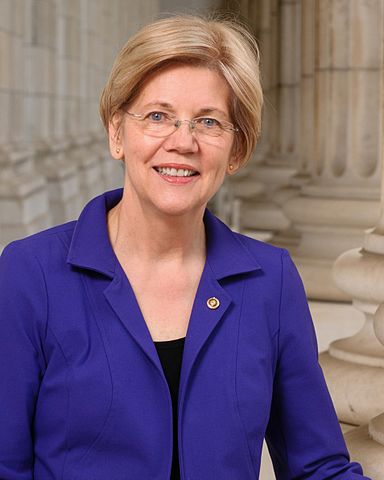

Elizabeth Warren proposes a wealth tax on, she says, a small portion of the population. That tax would not merely confiscate wealth; it would destroy it.

Senator Elizabeth Warren (D-Mass.) is, at this writing, the front-runner for the Democratic Party Presidential nomination in 2020. She has proposed a wealth tax as her signature program. That wealth tax presents a clear and present danger to property and liberty, if not to life. It might not even survive a challenge in the highest Court in the land. But even if it does, it bids fair, not merely to confiscate the nation’s wealth, but to destroy it.

Senator Warren – and her wealth tax – could win

Will Senator Warren take the nomination? Only consider her competition. Joe Biden makes enough gaffes to make this former physician question the health of his brain. Bernie Sanders recently took ill with a heart ailment and went in for surgery. The rest simply haven’t the traction for the campaign, even if it will last less than a year.

So all eyes must rest on Senator Warren and her wealth tax plan. She has proposed other programs, to be sure, that give a clue to her mindset. They include forbidding private health insurance, something even the United Kingdom did not do. (Though of course the old Soviet Union did.) But the wealth tax gets most of the attention. And to the wealth tax we now turn.

How the wealth tax would work

The most forthright—and likely sympathetic—explanation of the Warren wealth tax appears here. It taxes net worth exceeding $50 million at 2 percent per annum. For holdings totaling $1 billion, the marginal tax rate goes up to 3 percent per annum. Those holdings include everything a person might hold in his name. They include homes, stocks, bonds, trust and retirement assets, and assets in the names of minor children. The tax would also count any one object of personal property worth $50,000 or more. Buyers of the Tesla Models S or X, take note. This affects you, though not buyers of Tesla Model 3, Chevrolet Bolt Premier, and models of a similar price.

Equivalent to property taxes?

Senator Warren knows that the federal government has never before taxed the assets of its citizens and lawful residents. In answer she points out that local governments tax real estate.

If you own a home, you’re already paying a wealth tax — it’s called a property tax. I just want the ultra-rich to pay a wealth tax on the diamonds, the yachts, and the Rembrandts too.

The wealth of the nation is in stocks and bonds!

Reading or listening to her might give the impression that the wealth of the ultra-wealthy does lie in diamonds, yachts, and works of art. That has never been true, except rarely in ancient Rome—witness Gaius Verres. He famously stole statuary from every province he governed, before the future consul Cicero prosecuted him. But even in ancient Rome, the richest men in Rome owned their equivalent of stock. Or they owned real estate and rented it out to profitable businesses. (Examples: Marcus Licinius Crassus, Gnaeus Pompeius Magnus, and Gaius Julius Caesar.) And such is the case today.

Furthermore, for the last forty years, stocks (and, to a lesser degree, bonds) have more than doubled in value. In contrast, wages have barely grown at all. So those wealthy enough to own stocks, or even mutual funds, have seen their holdings grow in value. Those who haven’t bought stocks, have stayed still. Today 1 percent of the country’s citizens and lawful residents have as much wealth as the first 90 percent.

So what happens when such a wealth tax goes into effect?

Don’t look for the wealthy to walk meekly up to the tax office window and pay the tax. They will do what they must to avoid paying. Whether the “trust dodge” will still work is anyone’s guess; some say it will. Or they will give the money now to their adult children, or to their friends. Or they will renounce not only their American residency but also their American citizenship.

But suppose they can’t shed their holdings fast enough? What will they do then? One thing they will not do is part with their Rembrandts and Van Goghs and so on. Or if they do, they’ll eventually run out of art works to sell. Remember: we simply do not have a cadre of Gaius Verreses in America, or elsewhere in the world, today. Instead we have Crassi, Pompeys, and Caesars. And today these modern plutocrats hold stocks and bonds.

Those, therefore, are what those who can’t “get connections” will sell.

The wealth tax will tank the stock market

What does anyone think will happen to the stock market then? Doesn’t it become obvious? One of the biggest bargains in real estate is the tax sale. When a town sells a house for taxes it typically gets fifty cents on the dollar.

That’s what every stockholder could be looking at. For the super-wealthy, this could solve the problem. Their holdings would re-value at a price at or even below book value. And that would apply to the not-so-wealthy, too. People would see their retirement savings vanish faster than would a piece of metal after dipping it into sulfuric acid.

Does she care?

Does Senator Warren even care about that effect of her wealth tax? Does she even know? Your editor will admit the bare possibility that she does not know. She did not train in economics. And even if she had, she might have “studied to the test” while rejecting economic principles as unmutual1 and cruel. (Representative Alexandria Ocasio-Cortez, D-N.Y., must have done this.)

But more likely even if someone explained this effect to here, she would. Not. Care. Consider her proposal to forbid private health insurance. That bespeaks a desire to acquire all those stocks and bonds at fire-sale (“book”) prices. But she would acquire them, not in her own name, but “In the Name of the People.” So the federal government would become a holding company. Officials would then begin at once to replace management at all levels with the well-connected. A new Council of Economic Advisers would abolish prices and substitute input-output analysis for the signals prices give the economy.

The wealth tax threshold will not stop at $50 million

Furthermore, who says the threshold will stop at $50 million dollars? If the history of the income tax can guide us, it certainly will not! A bond broker told your editor this morning,

What happens when its $25 million, and then $10 million? This is redistribution of wealth!

Or maybe not so much redistribution as

the destruction of wealth, thus making nationalization easier.

And how do we know this about the wealth tax? What else Senator Warren proposes

Already she has said

she would, by 2035, permit no person to own a car or home that

“emitted carbon.” Nor would she permit “carbon emitting”

electricity generation.

Imagine how close that is to the nationalization of all industry, the repossession of all private homes, and the holding of all things in common.

That is what Senator Warren’s wealth tax will do. It is how she designed it.

Consider this, too. Senator Warren will not let Beto “H__l yes, we’re going to take your guns” O’Rourke outdo her. Instead she will tax guns at 30 percent, and ammo at 50 percent. Result: the poor won’t be able to afford them.

As a frequent CNAV contributor reminds us: whom the government would enslave, it first disarms.

Endnote

1 This word comes from a key episode of an art-house-type television show, The Prisoner, presented by Sir Lew Grade, produced by Patrick McGoohan and starring Patrick McGoohan; Grenada Television, 1967.

Terry A. Hurlbut has been a student of politics, philosophy, and science for more than 35 years. He is a graduate of Yale College and has served as a physician-level laboratory administrator in a 250-bed community hospital. He also is a serious student of the Bible, is conversant in its two primary original languages, and has followed the creation-science movement closely since 1993.

-

Accountability3 days ago

Accountability3 days agoWaste of the Day: Principal Bought Lobster with School Funds

-

Executive1 day ago

Executive1 day agoHow Relaxed COVID-Era Rules Fueled Minnesota’s Biggest Scam

-

Civilization9 hours ago

Civilization9 hours agoWhy Europe Shouldn’t Be Upset at Trump’s Venezuelan Actions

-

Constitution2 days ago

Constitution2 days agoTrump, Canada, and the Constitutional Problem Beneath the Bridge

-

Civilization1 day ago

Civilization1 day agoThe End of Purple States and Competitive Districts

-

Christianity Today9 hours ago

Christianity Today9 hours agoSurprising Revival: Gen Z Men & Highly Educated Lead Return to Religion

-

Civilization5 days ago

Civilization5 days agoThe devil is in the details

-

Executive21 hours ago

Executive21 hours agoWaste of the Day: Can You Hear Me Now?