Money matters

Fiscal Cliff: more lies, taxes and recession

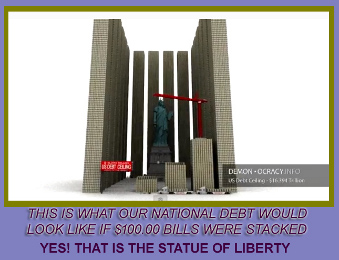

Congress did not avert the “fiscal cliff.” This government went over that cliff long ago. The numbers, when you read them, tell the tale.

Question! Can a person who smokes 40 cigarettes a day, suffering from full-blown lung cancer avert a miserable demise by cutting out one cigarette a week? Can a bloody mess of mangled bodies and twisted steel be averted if the vehicle, traveling 100 mph, racing towards a concrete bridge abutment reduces its speed by 1/2 mile per hour?

The very first thing you need to know, if you don’t already, is that the so-called “fiscal cliff” was not averted as a result of this past week’s budget deal. Something can not be averted which has already occurred. Not only did these fools of financial Armageddon not cut one cigarette or slow down by 1/2 mph, they doubled down.

Fiscal cliff: numbers don’t lie

The National Debt Clock shows the total national debt and each citizen and lawful resident’s share of it. Photo: Hampton Roads Partnership, CC BY 2.0

To some, facts, numbers and statistics are boring, but keep in mind that is exactly what both parties want you to think and why, for so long, they have gotten away with the murder of our financial future. Please take just a few minutes to review the numbers on this last budget agreement. But, to start, let’s call it what it was and will be. Not an avoidance of the fiscal cliff. No, it was a bi-partisan financial suicide pact.

About the Usurper. This past week he has told the world that he does not consider spending to be the problem and ignores his nearly $6 Trillion deficit as well as the $16.4 Trillion US debt. In fact, for his agenda, which is to destroy our capitalistic economy and replace it with a Marxist Utopian society, over-spending is not a problem. It is the tool.

Facts on this suicide pact everyone should know:

- The amount of new taxes the government will take in will take 8 years to cover the deficit of Obama’s first four years.

- The increase in capital gains taxes, which Buffet and many other asset rich liberals were demanding, will take 514 years to cover Obama’s deficit of just his first year as Usurper and Chief.

- The projected additional tax dollars going to the government will be about $660 Billion a year. The word projected because that number fails, as it always does, to take into account the slowdown of investment and growth new taxes always create.

- Here’s a little ice water splash in the face of those Obama sycophants who were told only the nasty rich, those already paying for every government benefit check they receive each month, would be the only one’s paying more taxes. Everyone’s paycheck will be reduced by 2%. Not just those earning $400K a year but, everyone, even those on minimum wage who work a mop in McDonald’s. Most people, who may not be taking part in marijuana give away program, have no doubt already noticed their paycheck has shrunk.

- The deal does not include even one dollar of spending cuts for at least two years which, if we can rely on history, means never.

- For every $1 this budget deal “supposes” it will take in, the Obama administration and your GOP, will spend $2.

- Those middle and upper middle-income earners, who have worked, saved and invested, and who have paid taxes on everything they own, everything they have earned, if they have been successful in acquiring a second home, a decent investment portfolio and other assets, good news. This budget deal steals 40% of your children s’ inheritance. Keep in mind that only those without the top flight accountants will pay this tax. As always, multi-millionaires and billionaires will work the system, through annuities and trusts, to get under that $5 million threshold.

- Regardless of whether or not the increase in tax rates on income will affect only the “productive rich”, everyone will pay more for services and products as corporations raise prices or go out of business. Those who purchase, pay the tax increases.

This Fiscal Cliff thing was, just as every other political phraseology has been, just another made up crisis scenario used to perpetrate yet another occasion to further destroy our country. Oh yea!, There is a crisis alright. But the train is already headed to the bottom of the canyon. This bi-partisan suicide pact did not slow it down. It actually sped it up.

Will the GOP take the deficit spending tool out of Obama’s hands? The answer is, no. They will not stop his intentional economic destruction and they will go down in history as equal partners.

Reprinted from Tea Party Advocate Tracking Hub

[subscribe2]

-

Civilization4 days ago

Civilization4 days agoTariffs, the Supreme Court, and the Andrew Jackson Gambit

-

Civilization2 days ago

Civilization2 days agoMaduro’s Capture: U.S. Foreign Policy in Latin America

-

Civilization4 days ago

Civilization4 days agoWhy Europe’s Institutional Status Quo is Now a Security Risk

-

Civilization5 days ago

Civilization5 days agoEpstein and the destruction of trust

-

Executive5 days ago

Executive5 days agoWaste of the Day: Wire Fraud, Conflicts of Interest in Connecticut

-

Civilization3 days ago

Civilization3 days agoTrump Lashes Out at Supreme Court as Under ‘Foreign Influence’

-

Civilization4 days ago

Civilization4 days agoSvalbard: The Other Arctic Island Flashpoint

-

Civilization3 days ago

Civilization3 days agoTrump Administration Led With the Wrong Agency in Minnesota

Michael Alan Kline Sr liked this on Facebook.

Politics aside (silly to say) of weather it is right/fair to have a progressive tax system;

1) the 40% estate tax is for value over $5.12 million per individual.

2) The median (50th percentile) net worth of american family was $93,000 in 2012. Fox news published an article stating “upper-income” families as having a net worth of $574,000 (2012).

3) Leonard Beeghley, 2004: states that only the top 5% of households have net worth over $1Million (and refers to these as “The Rich”) at that time.

Given these points, I find it hard to expect it is reasonable to describe someone with a net worth over 50 times the median 2012 figure and 10 times “upper-income” figure and would probably be in the top 5% of households to be “middle [or] upper-middle class”.

wow, should habe been “weather it is right/fair” not “weather…”. That was an embarrassing homophone mistake to make.

wow, should have been “weather it is right/fair” not “weather…”. That was an embarrassing homophone mistake to make.

“Thou shalt not covet thy neighbor’s house.” Or his estate. And that’s what your proposition is all about: envy. Never a good part of public policy.