Money matters

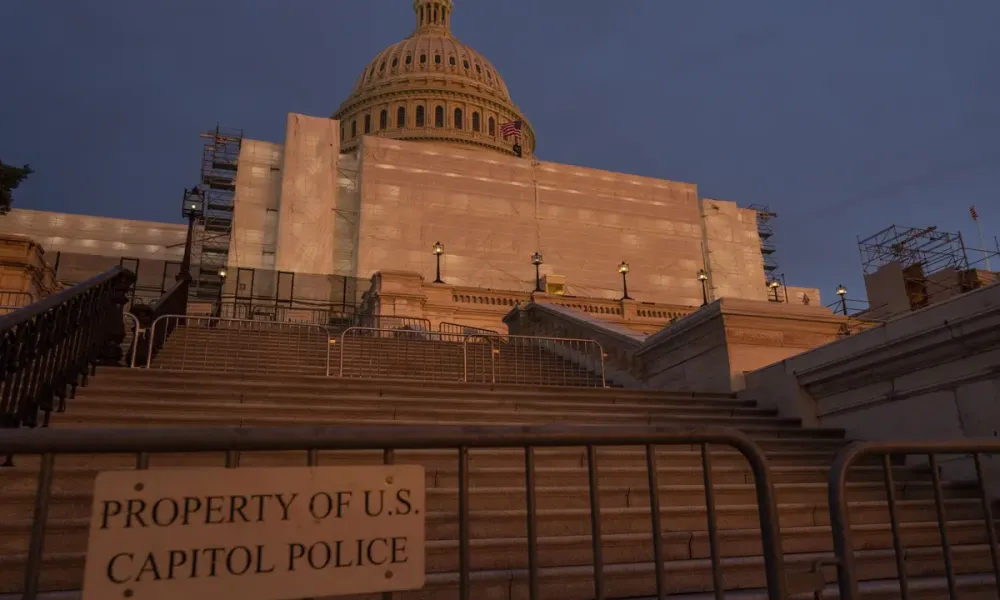

US could default this summer unless $31.4tn debt ceiling is raised, CBO warns

On Wednesday the Congressional Budget Office made the projection that the US could face the possibility of defaulting on its debt this summer if Congress doesn’t take swift action and raise the $31.4 trillion debt limit.

A report from the CBO released Wednesday re-iterated this, “Currently, the statutory limit on the issuance of new federal debt is set at $31.4 trillion. On January 19, 2023, debt reached that limit, and the Treasury announced a ‘debt issuance suspension period,’ during which, under current law, it can take well-established ‘extraordinary measures’ to borrow additional funds without breaching the debt ceiling.”

“CBO estimates that under its baseline budget projections, the Treasury would exhaust those measures and run out of cash sometime between July and September of this year. The Deficit Control Act requires CBO to project spending,” the office said.

The Treasury Department has resorted to “extraordinary measures” to avoid going down this road, and Treasury Secretary Janet Yellen gave Congress an “early June” deadline to work out a deal with President Biden to raise the debt limit.

If congress cannot thrash out a deal to raise the debt ceiling, the government may be forced to temporarily default on some of its expenditures.

The Committee for a Responsible Federal Budget said that should the US default on its debt, interest rates would also spike.

The US has not defaulted on its debt before, however it did come close to doing so in 2011 House Republicans voted against or abstained on a debt-ceiling increase, which prompted Standard and Poor to downgrade the U.S. debt rating one notch.

“In 2011, when we were at risk of default, it had enormous harm on the economy. It hurt the economy. It plummeted consumer confidence that hurt growth and jobs, just the threat of default,” Sterling noted.

“Just the notion that the United States is a place where one political party could hold hostage the full faith and credit of the United States could threaten default to get what I think are rather extreme budget view,” he added. “Any policy preference at all is going to be very damaging, and you will hear this from the Chamber of Commerce, not just this White House. The risk and threat of default is a risk economic catastrophe for all Americans.”

Republicans, who now have control of The House of Representatives, have said they will hold back on negotiating a debt limit increase until Democrats agree to deep spending cuts. Democrats have hit out at this stance by saying debt limit should not be “held hostage” to Republican tactics over federal spending.

Terry A. Hurlbut has been a student of politics, philosophy, and science for more than 35 years. He is a graduate of Yale College and has served as a physician-level laboratory administrator in a 250-bed community hospital. He also is a serious student of the Bible, is conversant in its two primary original languages, and has followed the creation-science movement closely since 1993.

-

Executive5 days ago

Executive5 days agoThe Hunters Have Now Become The Hunted: Their Cruelties Are Swelling The Ranks Of The People Worldwide!

-

Clergy4 days ago

Clergy4 days agoWhy Do The American People Let The Corrupt Media & Politicians Set The Propaganda Narrative – Speak On Their Behalf

-

Constitution5 days ago

Constitution5 days agoCHAPTER 9: Norman Dodd Interview Space Is No Longer the Final Frontier––Reality Is [upcoming release April 2024]

-

Entertainment Today4 days ago

Entertainment Today4 days agoCivil War (2024) – an incomplete prediction

-

![CHAPTER 10: Objective Reality Is Required for a Free Society Space Is No Longer the Final Frontier—Reality Is [upcoming release May 2024]](https://cnav.news/wp-content/uploads/2024/04/Objective-reality-v-acceptance-400x240.png)

![CHAPTER 10: Objective Reality Is Required for a Free Society Space Is No Longer the Final Frontier—Reality Is [upcoming release May 2024]](https://cnav.news/wp-content/uploads/2024/04/Objective-reality-v-acceptance-80x80.png) Education4 days ago

Education4 days agoCHAPTER 10: Objective Reality Is Required for a Free Society Space Is No Longer the Final Frontier—Reality Is [upcoming release May 2024]

-

Human Interest3 days ago

Human Interest3 days agoIdaho prepares to defend its abortion ban

-

Civilization2 days ago

Civilization2 days agoEarth Day Should Celebrate U.S. Progress & Innovation

-

Education2 days ago

Education2 days agoThe Intifada Comes to America. Now What?

The key thing is to stop spending money on Unconstitutional programs. I suspect close to 70% of spending is unconstitutional specific Welfare spending.